Introduction

In the realm of investments, gold has long been considered a safe haven asset providing stability, security, and diversification to portfolios. As we look towards 2024, the question on many investors’ minds is whether gold prices will continue their upward trajectory. In this article, we will delve into the expert predictions surrounding gold prices in 2024 and explore the key factors that may influence its performance.

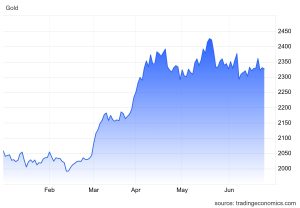

What to Expect in 2024

Gold prices are influenced by a myriad of factors, including global economic conditions, geopolitical tensions, inflation rates, and central bank policies. As we head into 2024, the economic landscape remains uncertain, with ongoing geopolitical conflicts, fluctuating inflation rates, and central bank interventions. These elements will undoubtedly impact gold prices and shape the trajectory of the precious metal in the coming year.

This image is property of s3-us-west-2.amazonaws.com.

Factors Affecting Gold Prices

To better understand the potential movement of gold prices in 2024, let’s examine some of the key factors that are likely to play a significant role in shaping its performance.

Global Economic Conditions

The state of the global economy has a profound impact on gold prices. Economic instability, high levels of debt, and currency devaluation can drive investors towards gold as a safe haven asset. In 2024, factors such as trade tensions, government stimulus packages, and pandemic recovery efforts will influence the economic outlook and, consequently, gold prices.

Geopolitical Tensions

Political instability, conflicts, and geopolitical tensions can lead to market volatility and uncertainty, prompting investors to seek refuge in gold. Ongoing geopolitical conflicts and diplomatic standoffs can elevate gold prices as investors flock to the metal for its perceived stability and resilience.

Inflation Rates

Inflation erodes the value of fiat currencies, making gold an attractive hedge against rising prices. As central banks navigate inflation rates in 2024, any signs of persistent inflationary pressures could bolster gold prices as investors seek tangible assets to safeguard their wealth.

Central Bank Policies

Central bank actions, such as interest rate decisions, monetary policy adjustments, and quantitative easing programs, can impact gold prices. In 2024, the response of central banks to economic challenges and inflationary pressures will be closely watched for their effects on the precious metal.

Expert Predictions for 2024

While predicting the exact movement of gold prices is inherently challenging, experts in the field have offered their insights and forecasts for 2024. Let’s explore some of the expert predictions regarding gold prices in the upcoming year.

Bullish Outlook

Some experts anticipate a bullish trend for gold prices in 2024, citing factors such as economic uncertainty, geopolitical risks, and inflation concerns. A continued demand for safe haven assets and gold’s historical role as a store of value could drive prices higher in the face of market volatility.

Bearish Sentiment

Conversely, other experts express a more cautious outlook, pointing to potential economic recovery, stable inflation rates, or central bank interventions that could dampen gold prices. A stronger US dollar, reduced investor appetite for risk, and easing geopolitical tensions may exert downward pressure on gold prices.

Range-Bound Expectations

Certain analysts predict that gold prices in 2024 may trade within a narrow range, reflecting a balanced market sentiment between bullish and bearish factors. Price fluctuations within a specific range could indicate market stability and investor confidence in gold as a reliable asset.

This image is property of www.techopedia.com.

The Role of GoldFun in Gold Investment

As investors navigate the complexities of the gold market and consider their options for gold investment, platforms like GoldFun offer a comprehensive suite of services to facilitate trading, storage, and portfolio diversification. Let’s explore the unique features of GoldFun that make it a trusted partner for precious metal investment.

Trading Platform Features

GoldFun provides a user-friendly online trading platform that offers real-time market data, advanced charting tools, and seamless transactions for buying, selling, and trading gold. The platform’s transparency, security measures, and accessibility cater to both novice and experienced investors seeking to participate in the gold market.

Storage Solutions

In partnership with reputable storage facilities, GoldFun offers insured storage options for physical gold holdings, ensuring the safety and protection of investors’ assets. Secure storage solutions guard against risks such as theft, loss, or damage, providing peace of mind and confidence in the security of one’s investments.

Comprehensive Services

GoldFun’s range of services encompasses gold refining, production, trading, and price hedging, offering end-to-end solutions for investors seeking exposure to the precious metal. With membership in esteemed industry organizations like the Hong Kong Gold & Silver Exchange Society, GoldFun upholds a reputation for reliability, transparency, and excellence in gold investment services.

This image is property of cdn.litemarkets.com.

Conclusion

As we approach 2024, the outlook for gold prices remains subject to a myriad of global factors, economic conditions, and market uncertainties. While expert predictions offer valuable insights into potential price movements, the dynamic nature of the gold market underscores the need for prudent decision-making and informed investment strategies. Whether gold prices go up, down, or remain stable in 2024, the enduring allure of gold as a store of value and a strategic asset in diversified portfolios underscores its timeless relevance in the world of investments.

If you have any questions, please don’t hesitate to contact us at info@fastcashva.com