Introduction

Gold has long been revered as a valuable asset, a symbol of wealth and stability in the investment world. With its intrinsic value and historical significance, gold has attracted investors seeking to diversify their portfolios and protect their wealth. However, predicting the future direction of gold prices can be a daunting task, influenced by various economic, geopolitical, and market factors. In this article, we will delve into the top five expert predictions on whether gold prices will go down, providing valuable insights for individual investors, wealth managers, and trading professionals interested in precious metals investment.

Why Invest in Gold?

Gold has been recognized for centuries as a safe haven asset, offering protection against economic uncertainty, inflation, and currency fluctuations. Its inherent value and limited supply make it a reliable store of wealth, with a long history of preserving purchasing power over time. By investing in gold, investors can diversify their portfolios, hedge against market volatility, and potentially achieve capital appreciation.

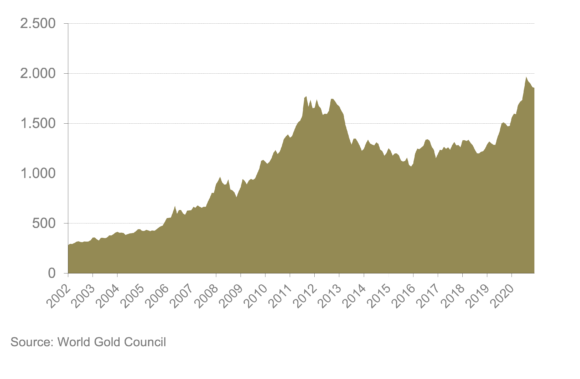

This image is property of www.trustablegold.com.

Expert Predictions

Expert #1: Bank of America Merrill Lynch

According to Bank of America Merrill Lynch, gold prices are expected to remain stable in the near term, supported by low interest rates and ongoing geopolitical risks. The bank forecasts that gold prices could potentially reach $2,000 per ounce in the coming months, driven by strong demand for safe-haven assets amidst global uncertainties. However, the bank also warns of downside risks, such as a stronger U.S. dollar and improving economic conditions, which could put pressure on gold prices.

Expert #2: Goldman Sachs

Goldman Sachs predicts a more bearish outlook for gold prices, citing the potential for rising interest rates and a stronger U.S. dollar. The investment bank expects gold prices to decline in the short term, with a target price of $1,800 per ounce by the end of the year. Goldman Sachs highlights the inverse relationship between gold prices and real interest rates, suggesting that higher rates could dampen investor demand for gold as a non-yielding asset.

Expert #3: JPMorgan Chase

JPMorgan Chase takes a more neutral stance on gold prices, emphasizing the importance of diversification and risk management in uncertain market conditions. The bank acknowledges the role of gold as a portfolio hedge against inflation and market volatility but cautions against overexposure to the precious metal. JPMorgan Chase advises investors to maintain a balanced portfolio with a mix of assets to mitigate risks and enhance long-term returns.

Expert #4: Citigroup

Citigroup provides a bullish outlook on gold prices, citing the potential for continued economic stimulus measures and inflationary pressures. The financial services firm believes that gold has room for further upside, with a target price of $2,100 per ounce in the medium term. Citigroup emphasizes the favorable macroeconomic environment for gold investment, including low real interest rates, central bank buying, and increasing demand from emerging markets.

Expert #5: UBS

UBS presents a cautious view on gold prices, cautioning against excessive optimism and market speculation. The Swiss multinational investment bank expects gold prices to be range-bound in the near term, influenced by factors such as currency movements and risk sentiment. UBS advises investors to exercise caution and prudence when trading gold, emphasizing the importance of risk management and long-term investment strategies.

Conclusion

In conclusion, the future direction of gold prices remains uncertain, with conflicting expert predictions and market dynamics at play. While some forecasters anticipate a bullish trend driven by economic uncertainties and inflationary pressures, others warn of downside risks posed by interest rate hikes and a stronger U.S. dollar. As an investor interested in gold, it is essential to conduct thorough research, assess your risk tolerance, and seek professional advice to make informed investment decisions. By staying informed and proactive, you can navigate the complexities of the gold market and capitalize on opportunities for wealth preservation and growth.

If you have any questions, please don’t hesitate to contact us at info@fastcashva.com