Introduction

When it comes to investing, avoiding mistakes is crucial to achieving success and maximizing returns. In the world of financial markets, errors can be costly and detrimental to your portfolio. Without the guidance of AGA’s AI system, investors often fall prey to common pitfalls that hinder their investment outcomes. In this article, we will discuss the five alarming mistakes that investors make without utilizing AGA’s innovative AI technology. By understanding these errors, you can mitigate risks and enhance your investment strategy for optimal results.

Understanding the Role of AI in Investment

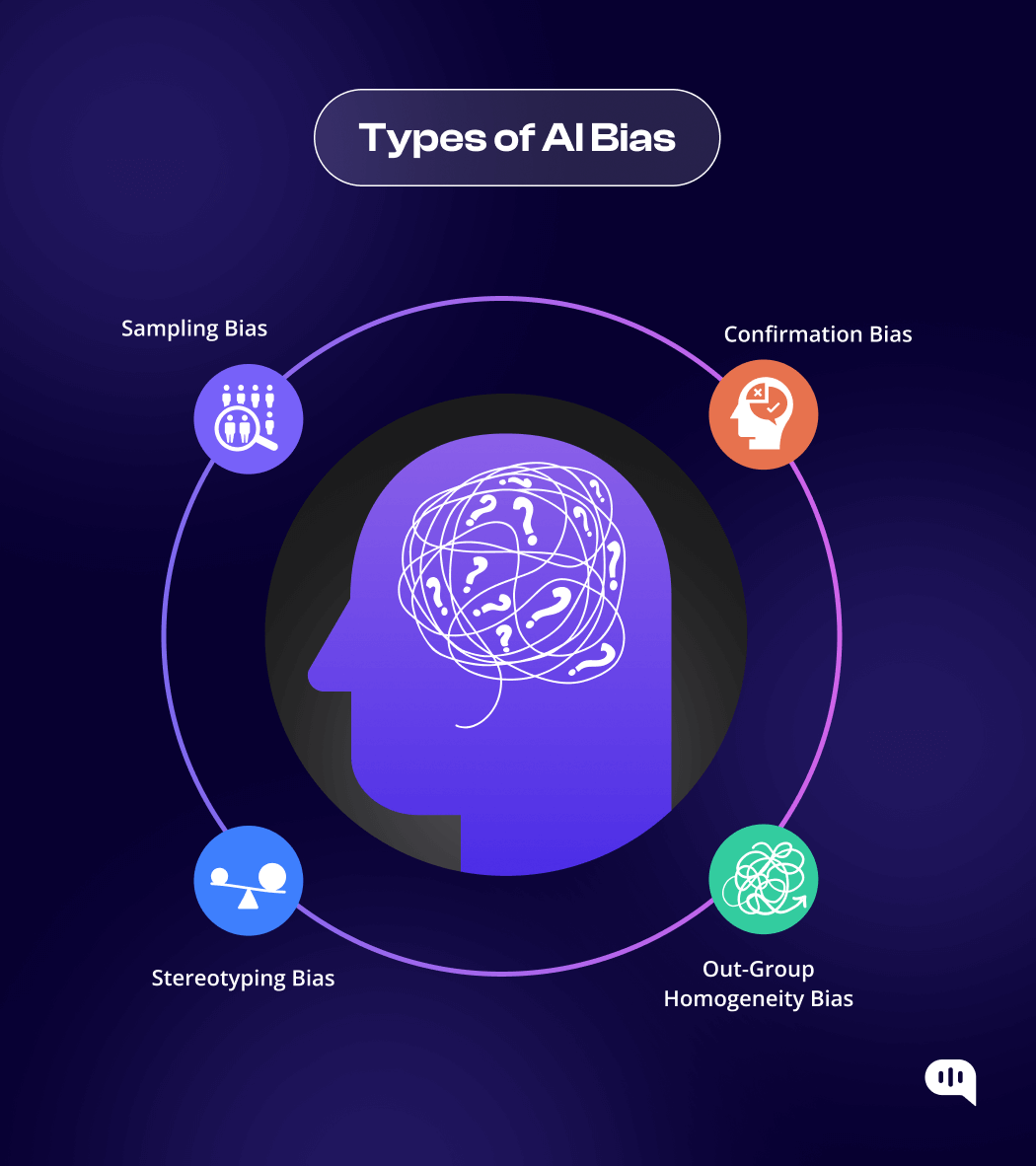

Before delving into the specific mistakes investors make without AGA’s AI system, it’s essential to grasp the significance of artificial intelligence in the realm of investing. AI technologies, such as those employed by AGA, empower investors with advanced tools for data analysis, trend prediction, and automated decision-making. By leveraging AI, investors can access real-time insights, optimize trading strategies, and minimize human errors in the investment process. AGA’s AI system offers a competitive edge by providing sophisticated algorithms that adapt to market conditions and capitalize on opportunities swiftly and efficiently. Understanding the transformative power of AI in investment is key to unlocking its full potential and maximizing returns.

The 5 Alarming Mistakes Investors Make Without AGA’s AI System

Mistake 1: Lack of Data-Driven Insights

One of the critical errors investors make without AGA’s AI system is relying on subjective judgment rather than data-driven insights. Traditional investment approaches often involve emotional decision-making, cognitive biases, and heuristics that can cloud judgment and lead to suboptimal outcomes. Without AI-powered analytics and machine learning algorithms, investors may overlook crucial market trends, overlook opportunities, or misinterpret data, resulting in missed profit potential and increased risks. AGA’s AI system eliminates this mistake by providing accurate, real-time data analysis, and predictive modeling that inform strategic decision-making based on objective and quantitative insights.

Mistake 2: Inadequate Risk Management

Another common mistake among investors without AGA’s AI system is inadequate risk management practices. Effective risk management is essential to safeguarding investments, preserving capital, and ensuring long-term profitability. Without AI-driven risk assessment tools and scenario modeling capabilities, investors may expose themselves to undue risks, market volatility, and unforeseen events that can lead to significant losses. AGA’s AI system offers a comprehensive risk management framework that utilizes advanced algorithms to assess risk levels, optimize portfolio diversification, and implement hedging strategies to protect against market downturns. By leveraging AGA’s AI system, investors can enhance their risk management practices and minimize exposure to potential threats.

Mistake 3: Limited Market Access and Liquidity

Investors without AGA’s AI system often face challenges related to limited market access and liquidity, which can impact trading efficiency and execution quality. In traditional trading environments, investors may encounter delays, slippage, and suboptimal pricing due to restricted liquidity pools and inefficient execution processes. AGA’s AI system overcomes this challenge by providing multi-liquidity access to various market providers, ensuring competitive pricing, fast order execution, and deep market liquidity. By accessing multiple liquidity sources and leveraging ultra-high-frequency trading techniques, investors can enhance their trading efficiency, reduce execution costs, and capitalize on diverse market opportunities for optimal returns.

Mistake 4: Missed Arbitrage Opportunities

One of the significant drawbacks for investors without AGA’s AI system is the potential to miss lucrative arbitrage opportunities across different markets. Arbitrage trading involves capitalizing on price differentials between assets, markets, or exchanges to generate risk-free profits. Without sophisticated algorithms and real-time data processing capabilities, investors may overlook arbitrage opportunities, fail to exploit price differentials efficiently, or lack the agility to execute trades swiftly. AGA’s AI system excels in identifying, analyzing, and capitalizing on arbitrage opportunities through advanced quantitative models, automated trading strategies, and real-time market monitoring. By leveraging AGA’s AI system, investors can maximize their arbitrage potential, generate consistent profits, and diversify their trading strategies with minimal risk exposure.

Mistake 5: Inefficient Investment Management

Lastly, investors without AGA’s AI system may fall victim to inefficient investment management practices that hinder portfolio performance and growth. Ineffective allocation of capital, manual trade execution, and lack of systematic investment strategies can lead to subpar returns, missed opportunities, and reduced scalability in the investment process. AGA’s AI system revolutionizes investment management by offering the Percentage Allocation Management Module (PAMM) model, which enables automated trade execution, profit distribution, and risk management based on individual investors’ capital proportions. Through the PAMM model, investors can customize their investment preferences, optimize capital allocation, and benefit from a streamlined and efficient investment management framework. By integrating AGA’s AI system into their investment approach, investors can enhance their portfolio performance, automate routine tasks, and achieve sustainable growth in the financial markets.

This image is property of miro.medium.com.

Conclusion

In conclusion, the five alarming mistakes discussed above highlight the critical importance of AGA’s AI system in optimizing investment outcomes, mitigating risks, and maximizing profitability in the financial markets. By avoiding these common errors and leveraging AGA’s innovative AI technology, investors can enhance their decision-making processes, improve risk management practices, access diverse market opportunities, capitalize on arbitrage potentials, and streamline investment management functions effectively. AGA’s AI system empowers investors with cutting-edge tools and strategies that drive consistent profits, underpin solid investment performance, and establish a foundation for sustainable growth in today’s dynamic financial landscape. Embracing AGA’s AI system is not just a choice but a strategic imperative for investors seeking to thrive and excel in the competitive world of investment management.

If you have any questions, please don’t hesitate to contact us at info@fastcashva.com