Introduction to Gold ETFs

Gold Exchange-Traded Funds (ETFs) have gained popularity among investors seeking exposure to the precious metal without the need for physical ownership. In this comprehensive guide, you will delve into the world of Gold ETFs and discover how they can enhance your investment portfolio.

Understanding Gold ETFs

Gold ETFs are financial instruments that are backed by physical gold holdings. By investing in a Gold ETF, you are essentially buying a share of the total gold reserves held by the fund. This allows you to benefit from the price movements of gold without holding the physical asset.

This image is property of av.sc.com.

Benefits of Investing in Gold ETFs

Investing in Gold ETFs offers a range of advantages for both newbie and seasoned investors alike. From diversification to liquidity, Gold ETFs provide a convenient and cost-effective way to access the gold market.

Liquidity

Gold ETFs are traded on major stock exchanges, providing investors with the flexibility to buy and sell their positions easily. This high liquidity makes it simple to enter and exit positions, ensuring that your investment is not tied up for extended periods.

Diversification

Gold ETFs offer investors exposure to the gold market, diversifying their portfolio and reducing the overall risk. By incorporating gold ETFs into your investment strategy, you can offset potential losses in other asset classes during market downturns.

Cost-Effective

Compared to buying physical gold, investing in Gold ETFs is a cost-effective way to gain exposure to the precious metal. With lower expenses, such as storage and insurance fees, Gold ETFs present a more affordable investment option for many individuals.

How Gold ETFs Work

Gold ETFs work by holding physical gold in the form of bars or coins in a secure vault. Each unit of the ETF represents a proportional ownership of the underlying gold holdings. As the price of gold fluctuates in the market, the value of the ETF shares will also rise or fall accordingly.

Creation and Redemption

Authorized participants, typically large financial institutions, can create and redeem units of Gold ETFs based on the demand and supply in the market. This process allows the ETF to maintain its net asset value (NAV) in line with the prevailing market price of gold.

Tracking Gold Prices

Gold ETFs aim to track the price of gold by holding physical gold or gold futures contracts. By closely following the movements in the gold market, Gold ETFs provide investors with a transparent and efficient way to capitalize on gold price fluctuations.

This image is property of academy.musaffa.com.

Types of Gold ETFs

There are different types of Gold ETFs available in the market, each catering to the diverse needs and preferences of investors. Understanding the various types of Gold ETFs can help you choose the one that aligns best with your investment objectives.

Physical Gold ETFs

Physical Gold ETFs invest directly in physical gold bullions or coins. The fund holds the gold in secured vaults and aims to reflect the spot price of gold. Investing in physical gold ETFs provides investors with direct exposure to the precious metal.

Gold Mining ETFs

Gold Mining ETFs track the performance of companies engaged in gold mining activities. By investing in Gold Mining ETFs, investors can benefit from the profitability of gold mining companies, which are influenced by factors such as production costs and gold prices.

Leveraged Gold ETFs

Leveraged Gold ETFs use financial derivatives to amplify the returns of the underlying gold assets. These ETFs are designed for investors seeking higher risk and potential reward, as they offer leveraged exposure to the price movements of gold.

This image is property of miro.medium.com.

Risks of Investing in Gold ETFs

While Gold ETFs offer several benefits, it is essential to be aware of the potential risks involved in investing in these financial instruments. Understanding the risks can help you make informed investment decisions and manage your portfolio effectively.

Market Risk

Gold ETFs are subject to market risk, meaning that the value of your investment can fluctuate based on the performance of the gold market. Economic factors, geopolitical events, and investor sentiment can all impact the price of gold and, consequently, the value of your ETF holdings.

Counterparty Risk

Gold ETFs rely on financial institutions and custodians to store the physical gold holdings. As such, there is a counterparty risk associated with these entities. In the event of a default or insolvency of the custodian, investors may face challenges in recovering their investment.

Tracking Error

Some Gold ETFs may not perfectly track the price of gold due to factors such as management fees, operational costs, and tracking errors. A high tracking error can lead to discrepancies between the ETF’s performance and the actual price of gold, affecting the returns for investors.

This image is property of i.ytimg.com.

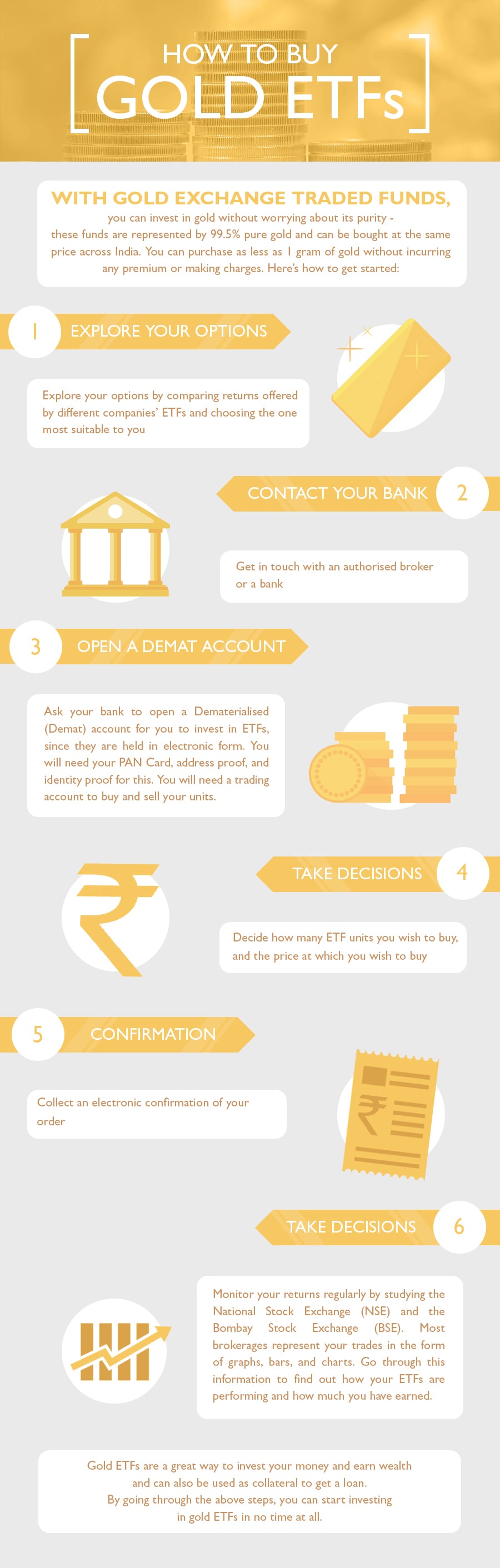

How to Invest in Gold ETFs

Investing in Gold ETFs is a straightforward process that can be done through a brokerage account. By following a few simple steps, you can start building your gold investment portfolio and capitalize on the benefits of Gold ETFs.

Open a Brokerage Account

To invest in Gold ETFs, you need to open a brokerage account with a reputable online broker. Choose a brokerage that offers access to a wide range of ETFs and competitive trading fees to maximize your investment potential.

Research Gold ETFs

Before investing, conduct thorough research on different Gold ETFs available in the market. Consider factors such as the fund’s expense ratio, tracking error, and investment objective to select the ETF that aligns with your investment goals.

Place Your Trade

Once you have selected the Gold ETF you wish to invest in, place a trade through your brokerage account. Specify the number of shares you want to purchase and review the transaction details before finalizing the trade.

Monitor Your Investment

After investing in Gold ETFs, regularly monitor the performance of your investment and stay informed about the latest developments in the gold market. Stay updated on economic indicators, geopolitical events, and market trends that can impact the price of gold.

This image is property of www.mygoldguide.in.

Conclusion

Gold ETFs offer investors a convenient and cost-effective way to gain exposure to the precious metal and diversify their investment portfolios. By understanding the benefits, risks, and types of Gold ETFs available, you can make informed investment decisions and navigate the complexities of the gold market with confidence. Start exploring the world of Gold ETFs today and unlock the potential for profitable gold investments.

If you have any questions, please don’t hesitate to contact us at info@fastcashva.com