“What Are 8 Powerful Advantages Of AGA’s Risk-Free Trading System?”

Introduction

In the realm of financial markets, navigating the complex landscape of trading can be a daunting task. With fluctuating market conditions, risk management is a critical aspect of any trading strategy. In this article, we will explore the powerful advantages of the Angel Guardian Alliance (AGA) Risk-Free Trading System. AGA’s innovative approach to trading combines AI-powered technology, quantum algorithms, and risk-free arbitrage strategies to help investors achieve consistent profits with minimized risks.

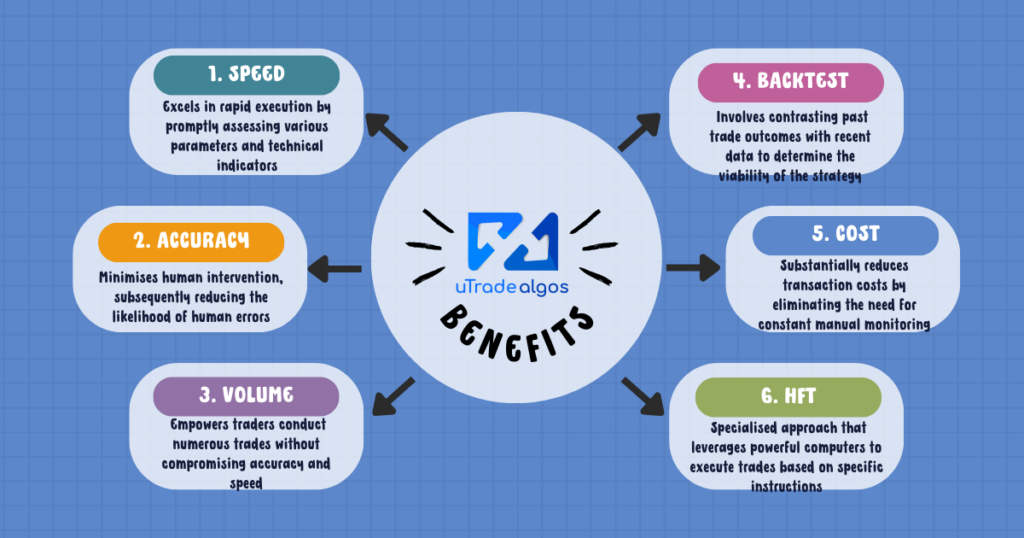

1. AI Quantitative Trading

AGA employs an AI quantitative trading system that relies on a quantum algorithm to automate analysis and trading decisions. This cutting-edge technology leverages data-driven insights and market trends to optimize trading outcomes. By minimizing human intervention and maximizing profitability, AGA’s AI trading system provides investors with a competitive edge in the market.

2. Zero Liquidation Risk

One of the key advantages of AGA’s Risk-Free Trading System is the elimination of liquidation risk. By utilizing ultra-high-frequency trading techniques with short holding times of under 30 seconds, AGA ensures stability and minimizes risks, even in highly volatile market conditions. This risk management strategy provides investors with peace of mind and safeguards their assets from potential losses.

This image is property of utradealgos.com.

3. Multi-Liquidity Access

AGA offers access to multiple liquidity providers, facilitating competitive pricing, fast execution, and deep market access. By diversifying liquidity sources, AGA enhances trading efficiency and reduces the impact of market fluctuations on trades. This multi-liquidity approach enables investors to optimize their trading strategies and capitalize on diverse market opportunities.

4. Risk-Free Arbitrage Opportunities

AGA’s Risk-Free Trading System identifies arbitrage opportunities across different markets, enabling investors to profit from price discrepancies without traditional trading risks. By leveraging arbitrage strategies, AGA generates a consistent income stream while minimizing risk exposure. This risk-free arbitrage approach sets AGA apart in the financial markets and offers investors a unique opportunity to maximize returns.

This image is property of fastercapital.com.

5. Percentage Allocation Management Module (PAMM) Model

The PAMM model allows AGA to provide tailored investment management services to investors. By authorizing the system to automatically execute trades and distribute profits based on individual capital proportions, investors can optimize their investment strategy and diversify their portfolio effectively. AGA’s PAMM model enhances the trading experience for investors, allowing for personalized investment management and seamless profit-sharing.

6. AGA AI Trading Packages and Rebate Structure

AGA’s trading system offers different trade rebates based on varying capital amounts, incentivizing larger capital allocations with higher rebates. This structured rebate system rewards investors based on trading volume, providing transparent and competitive incentives for maximizing returns. By aligning trade rebates with investment levels, AGA empowers investors to leverage their capital effectively and benefit from lucrative trading opportunities.

This image is property of fxtrendo.com.

7. Dual Income Model

AGA’s dual income model allows investors to earn from two key income streams: profit sharing and trade rebates. By receiving 50% of the profits generated by the AI trading system and earning trade rebates based on trading volume, investors can maximize their returns and diversify their income sources. This dual income model provides investors with a sustainable and balanced approach to wealth accumulation, combining consistent profitability with additional income streams.

8. Commission Rebate System

Agents can earn rebates by referring clients to AGA’s Risk-Free Trading System, encouraging network growth and rewarding active participation. With a tiered rebate structure based on sales levels, agents can maximize their earnings by expanding their client base and increasing their sales volume. AGA’s commission rebate system incentivizes agents to promote the trading platform and build strong relationships within their network, fostering sustainable growth and network development.

Conclusion

AGA’s Risk-Free Trading System offers investors a unique opportunity to participate in the financial markets with confidence and security. By leveraging AI technology, quantum algorithms, and risk-free arbitrage strategies, AGA provides a comprehensive trading solution that combines profitability with risk management. With a focus on transparency, efficiency, and innovation, AGA sets a new standard in AI-driven trading platforms, empowering investors to achieve their financial goals with minimal risks and maximum returns.

If you have any questions, please don’t hesitate to contact us at info@fastcashva.com