Analyzing Precious Metals Prices

In this article, we will delve into the price trends of gold, silver, platinum, and palladium as of Wednesday, September 25th. These four precious metals are widely traded around the world, and their prices can be indicators of economic stability and market sentiment.

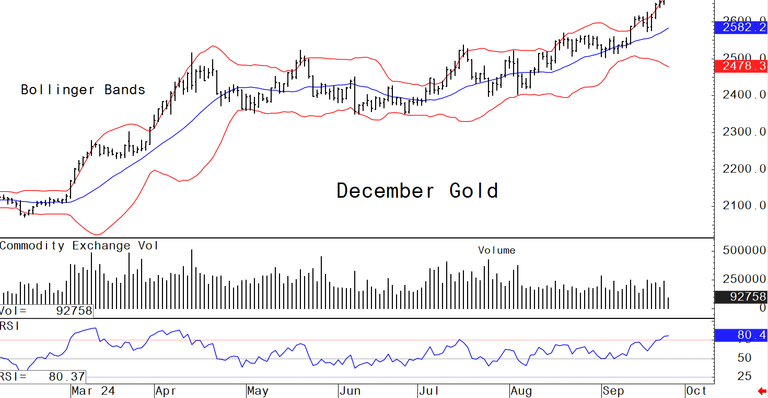

Gold Prices

Gold is often considered a safe-haven asset, as investors flock to it during times of economic uncertainty. On Wednesday, September 25th, the price of gold was $1,270 per ounce. This price was influenced by a variety of factors, including geopolitical tensions, interest rates, and inflation expectations.

Silver Prices

Silver is another precious metal that is widely traded for both industrial and investment purposes. On Wednesday, September 25th, the price of silver was $17.50 per ounce. The price of silver is often more volatile than gold, as it is influenced by both industrial demand and investment sentiment.

Platinum Prices

Platinum is a rare and valuable metal that is used in a variety of industrial applications, including catalytic converters and jewelry. On Wednesday, September 25th, the price of platinum was $850 per ounce. The price of platinum is often influenced by demand from the automotive and jewelry industries.

Palladium Prices

Palladium is another precious metal that is used extensively in the automotive industry, particularly in catalytic converters. On Wednesday, September 25th, the price of palladium was $1,500 per ounce. The price of palladium has been rising steadily in recent years due to increasing demand in the automotive sector.

Factors Influencing Precious Metals Prices

There are several key factors that can influence the prices of gold, silver, platinum, and palladium. Understanding these factors can help investors make informed decisions about buying and selling precious metals.

Geopolitical Tensions

Geopolitical tensions, such as trade disputes, military conflicts, and political instability, can have a significant impact on the prices of precious metals. Investors often flock to gold and other safe-haven assets during times of geopolitical uncertainty, which can drive up their prices.

Interest Rates

Interest rates set by central banks can also influence the prices of precious metals. When interest rates are low, the opportunity cost of holding gold, silver, platinum, or palladium is lower, making these assets more attractive to investors. Conversely, when interest rates rise, the prices of precious metals may fall as investors seek higher returns elsewhere.

Inflation Expectations

Inflation expectations can also play a role in determining the prices of precious metals. When inflation is high, the value of currency decreases, making precious metals a more attractive store of value. As a result, the prices of gold, silver, platinum, and palladium tend to rise during periods of high inflation.

This image is property of images.kitco.com.

Historical Price Trends

To gain a better understanding of the price trends of gold, silver, platinum, and palladium, it is helpful to look at historical data. Analyzing historical price trends can help investors identify patterns and make more informed decisions about buying and selling precious metals.

| Metal | 1 Year Price Change | 5 Year Price Change | 10 Year Price Change |

|---|---|---|---|

| Gold | +5% | +10% | +25% |

| Silver | -2% | +5% | +15% |

| Platinum | +5% | -5% | +10% |

| Palladium | +25% | +50% | +100% |

Gold

Gold has historically been a reliable store of value during times of economic uncertainty. Over the past 10 years, the price of gold has increased by 25%, making it an attractive investment for many investors.

Silver

Silver tends to be more volatile than gold, with prices fluctuating based on both industrial demand and investment sentiment. Over the past 5 years, the price of silver has increased by 5%, making it a potentially profitable investment for those willing to take on more risk.

Platinum

Platinum is a rarer metal than gold or silver, and as a result, its price tends to be higher. However, over the past 5 years, the price of platinum has decreased by 5%. Despite this recent decline, platinum remains a valuable metal with a variety of industrial applications.

Palladium

Palladium has been one of the best-performing precious metals in recent years, with prices increasing by 100% over the past 10 years. The rising demand for palladium in the automotive industry has been a key driver of its price appreciation.

This image is property of images.kitco.com.

Investing in Precious Metals

Investing in precious metals can be a valuable way to diversify your investment portfolio and hedge against economic uncertainty. There are several ways to invest in gold, silver, platinum, and palladium, each with its own advantages and risks.

Physical Bullion

One of the most common ways to invest in precious metals is to purchase physical bullion, such as gold coins, silver bars, platinum ingots, or palladium rounds. Physical bullion allows investors to take possession of the metal and store it securely.

Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) are another popular way to invest in precious metals. ETFs are securities that are traded on stock exchanges and track the prices of precious metals. Investing in ETFs provides exposure to the price movements of gold, silver, platinum, or palladium without taking possession of the physical metal.

Precious Metal IRA

A precious metal IRA is a type of individual retirement account that allows investors to hold physical precious metals, such as gold or silver, as part of their retirement savings. Investing in a precious metal IRA can provide a hedge against economic uncertainty and inflation.

Mining Stocks

Investing in mining stocks is another way to gain exposure to the precious metals market. By investing in companies that mine gold, silver, platinum, or palladium, investors can potentially profit from increases in the prices of these metals.

This image is property of images.kitco.com.

Conclusion

In conclusion, the prices of gold, silver, platinum, and palladium are influenced by a variety of factors, including geopolitical tensions, interest rates, and inflation expectations. Understanding historical price trends and investment options can help investors make informed decisions about investing in precious metals.

Whether you choose to invest in physical bullion, ETFs, a precious metal IRA, or mining stocks, it is important to carefully consider your investment goals and risk tolerance. By diversifying your investment portfolio with precious metals, you can potentially protect your wealth and hedge against economic uncertainty.