Analyzing Thursday’s Market Trends for Precious Metals

When reviewing the price movements of gold, silver, platinum, and palladium, it is essential to analyze current market trends to make informed decisions.

Gold Prices

Gold has long been considered a safe haven investment during times of economic uncertainty. Its value is influenced by various factors such as inflation rates, geopolitical tensions, and central bank policies.

Silver Prices

Silver is often referred to as “poor man’s gold” due to its relatively lower price compared to gold. Despite this, silver is still a popular investment choice for many due to its industrial applications as well as its value as a precious metal.

Platinum Prices

Platinum is rarer than both gold and silver, making it one of the most valuable precious metals. Its price is heavily influenced by supply and demand dynamics, particularly in the automotive industry where platinum is used in catalytic converters.

Palladium Prices

Palladium has seen a significant price increase in recent years due to its growing demand in the automotive sector. Being a key component in catalytic converters for gasoline-powered vehicles, palladium’s price is closely tied to regulations and the production of vehicles.

This image is property of images.kitco.com.

Factors Influencing the Price of Precious Metals

The prices of gold, silver, platinum, and palladium are subject to various factors that can cause fluctuations in value. Understanding these factors is crucial when investing in these precious metals.

Economic Indicators

Economic indicators such as GDP growth, interest rates, and unemployment rates can have a significant impact on the prices of precious metals. For example, a strong economy with low unemployment rates may result in lower demand for safe haven investments like gold.

Geopolitical Events

Geopolitical events such as trade tensions, political instability, and conflicts can cause fluctuations in precious metal prices. Investors often turn to gold and silver as safe haven assets during times of uncertainty.

Market Speculation

Speculation in the commodity markets can also affect the prices of precious metals. Traders and investors may buy or sell these metals based on their predictions of future price movements, leading to volatility in the market.

Currency Movements

Changes in currency values can impact the prices of precious metals, especially for gold which is often seen as a hedge against currency depreciation. A weaker currency can result in higher gold prices as investors seek to protect their wealth.

Technical Analysis of Precious Metal Prices

Technical analysis is a method used by traders to predict future price movements based on historical data and market trends. Here are some key technical indicators used in analyzing the prices of gold, silver, platinum, and palladium.

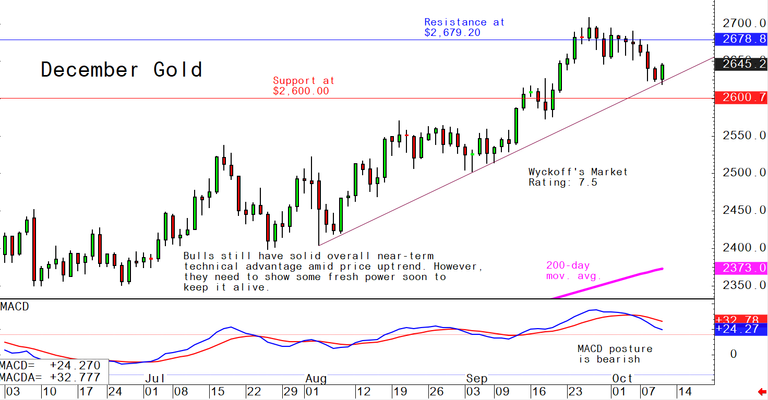

Moving Averages

Moving averages are used to smooth out price fluctuations and identify trends. Traders often look at the 50-day and 200-day moving averages to determine potential buy or sell signals for precious metals.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. An RSI above 70 indicates that a precious metal may be overbought, while an RSI below 30 suggests it may be oversold.

Support and Resistance Levels

Support and resistance levels are price points where a precious metal is likely to reverse direction. Traders use these levels to set stop-loss orders and identify potential entry and exit points for their trades.

Bollinger Bands

Bollinger Bands are used to measure price volatility and identify overbought or oversold conditions. When a precious metal’s price reaches the upper band, it may be considered overbought, while a price near the lower band may indicate oversold conditions.

This image is property of images.kitco.com.

Kitco NEWS Forecast for Thursday, October 10

Gold Price Forecast

According to Kitco NEWS, gold prices are expected to remain stable on Thursday, October 10, with a potential for slight gains due to continued economic uncertainty and geopolitical tensions.

Silver Price Forecast

Silver prices are also predicted to see some upward movement on Thursday, October 10, as investors seek safe haven assets amidst market volatility and trade tensions.

Platinum Price Forecast

Kitco NEWS forecasts a slight increase in platinum prices on Thursday, October 10, driven by strong demand in the automotive industry and favorable market conditions.

Palladium Price Forecast

Palladium prices are expected to continue their upward trend on Thursday, October 10, supported by growing demand in the automotive sector and supply constraints.

In conclusion, analyzing market trends, understanding the factors influencing precious metal prices, and using technical analysis can help investors make informed decisions when trading gold, silver, platinum, and palladium. Keeping abreast of news and forecasts from reliable sources like Kitco NEWS is essential for staying informed about the latest developments in the precious metals market.