Is gold still a safe haven in uncertain times?

Introduction

In times of economic uncertainty, investors often turn to gold and silver as safe haven assets. However, recent price fluctuations have raised questions about the resilience of these precious metals. In this article, we will explore the price pressures faced by gold and silver amid routine profit-taking.

The Historical Significance of Gold and Silver

Gold and silver have been valued for thousands of years for their beauty, rarity, and usefulness in a variety of industries. They have served as a store of value and a form of currency in many civilizations across the globe.

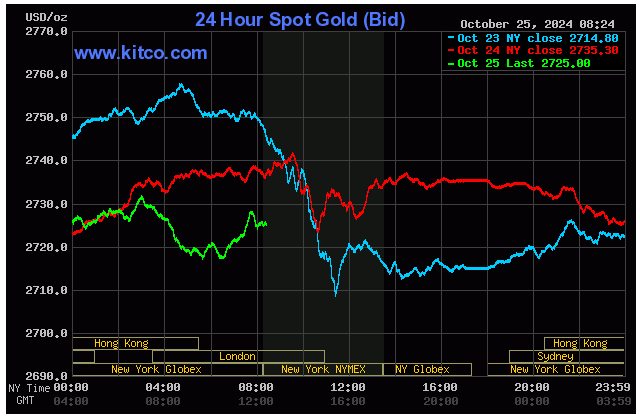

This image is property of images.kitco.com.

Gold: A Brief Overview

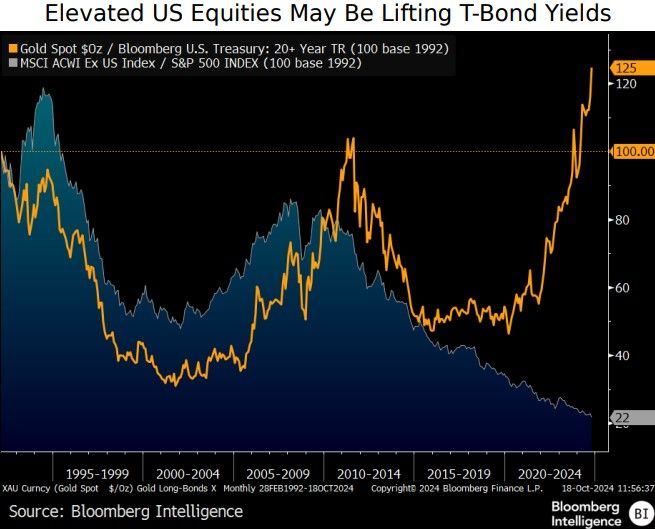

Gold has long been considered a safe haven asset, especially during times of economic turmoil. Its value is not directly tied to the performance of the stock market, making it an attractive option for investors looking to diversify their portfolios.

Factors Affecting Gold Prices

Several factors can influence the price of gold, including:

-

Supply and Demand: The supply of gold is limited, which can lead to price fluctuations based on demand.

-

Inflation: Gold is often seen as a hedge against inflation, as its value tends to increase when the purchasing power of fiat currencies decreases.

-

Geopolitical Tensions: Political instability and global conflicts can drive investors towards safe-haven assets like gold.

Recent Trends in Gold Prices

In recent months, gold prices have faced downward pressure due to a variety of factors, including:

-

Interest Rates: The Federal Reserve’s decision to raise interest rates can make gold less appealing, as it does not offer a yield like bonds or other interest-bearing assets.

-

Dollar Strength: A strong U.S. dollar can make gold more expensive for investors holding other currencies, leading to lower demand.

-

Speculative Trading: Speculators taking short positions on gold futures can drive prices down through selling pressure.

This image is property of images.kitco.com.

Silver: An Overview

Silver is often called “the poor man’s gold” due to its lower price per ounce compared to gold. It is used in a variety of industrial applications, including electronics, jewelry, and photography.

Factors Affecting Silver Prices

Similar to gold, silver prices can be influenced by factors such as:

-

Industrial Demand: The demand for silver in industrial applications can impact its price, especially during periods of economic growth or contraction.

-

Investor Sentiment: Like gold, silver can be seen as a safe haven asset, leading to increased demand during times of uncertainty.

-

Mining Production: The supply of silver can be affected by mining output, geopolitical issues, and environmental regulations.

Recent Trends in Silver Prices

Silver prices have also faced downward pressure recently, driven by factors such as:

-

Industrial Slowdown: The global economic slowdown has led to reduced demand for silver in industrial applications, contributing to lower prices.

-

Commodity Market Volatility: Silver, like other commodities, can be subject to price volatility based on market conditions and investor sentiment.

-

Profit-Taking: Investors selling silver holdings to take profits can lead to temporary price declines.

This image is property of images.kitco.com.

Investment Strategies for Precious Metals

If you are considering investing in gold or silver, it is important to develop a sound strategy that aligns with your financial goals and risk tolerance. Here are some common investment strategies for precious metals:

Physical Bullion

Purchasing physical gold or silver bullion coins or bars can provide a tangible asset that you can hold onto in times of crisis. However, storing and securing physical metal can come with its own set of challenges.

Exchange-Traded Funds (ETFs)

Investing in gold or silver ETFs can provide exposure to precious metals without the need to physically store the metal. ETFs can be bought and sold like stocks, making them a more liquid investment option.

Mining Stocks

Investing in mining companies that produce gold or silver can offer exposure to the precious metals market while also providing potential dividend income. However, mining stocks can be more volatile than the underlying metals themselves.

Precious Metals Futures

Trading futures contracts on gold or silver can be a more speculative investment strategy, as it involves leveraging and a higher degree of risk. Futures trading requires a good understanding of market dynamics and risk management.

This image is property of images.kitco.com.

Conclusion

In conclusion, gold and silver continue to be popular investment choices for individuals looking to diversify their portfolios and hedge against economic uncertainty. While recent price pressures may have deterred some investors, the long-term value proposition of these precious metals remains strong. By understanding the factors that influence gold and silver prices, investors can make informed decisions about how to incorporate these assets into their investment strategy.