How Does AGA’s Innovative AI Trading Make Fast Cash Effortless for You?

In today’s fast-paced financial markets, leveraging advanced technologies can give you an edge when it comes to trading. If you’re looking to maximize your profits while minimizing risks, AGA’s innovative AI trading system could be the solution you’ve been searching for. Let’s dive into how AGA’s cutting-edge platform utilizes AI-driven strategies to make fast cash effortless for you.

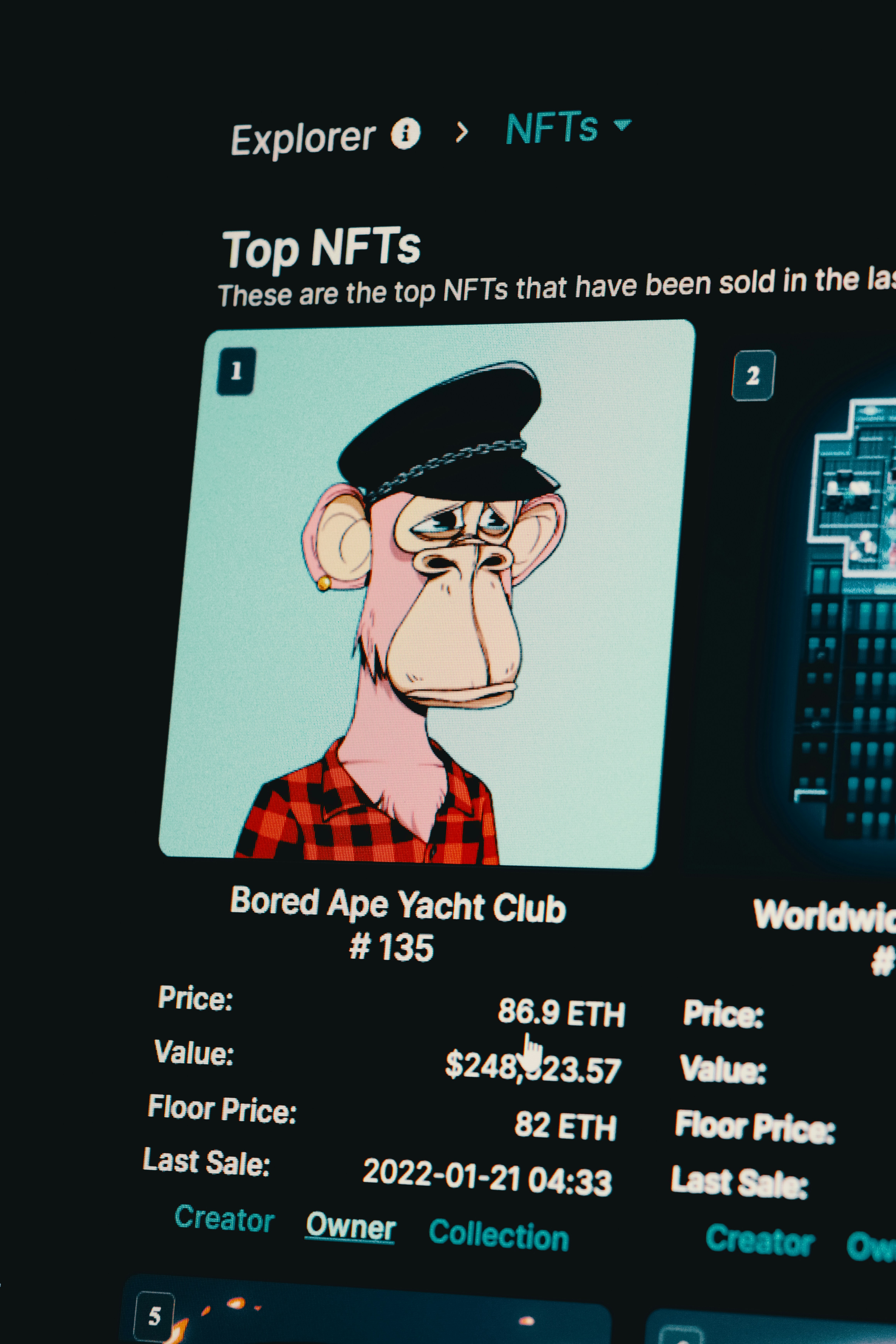

This image is property of images.unsplash.com.

Understanding AGA’s AI Quantitative Trading System

AGA’s AI quantitative trading system is at the core of its trading platform, offering automated analysis and trading decisions based on a quantum algorithm. This system leverages data-driven insights and market trends to optimize trading outcomes with minimal human intervention. By utilizing AI technology, AGA ensures that your trades are executed efficiently and effectively, maximizing profitability and minimizing risks.

AI Technology: A Game-Changer in Trading

AI technology has revolutionized the way trading is conducted in financial markets. By employing sophisticated algorithms and machine learning capabilities, AGA’s AI trading system can quickly adapt to changing market conditions, identify profitable opportunities, and execute trades at lightning speed. This advanced technology gives you a competitive advantage in the fast-paced world of trading, enabling you to capitalize on market trends and generate consistent profits.

Mitigating Risks with Zero Liquidation Risk

One of the key benefits of AGA’s AI trading system is its zero liquidation risk feature, which sets it apart from traditional trading platforms. By using ultra-high-frequency trading techniques with very short holding times (under 30 seconds), AGA ensures stability and minimizes risks, even in volatile market conditions. This innovative approach safeguards your investments and provides you with peace of mind as you trade.

The Importance of Risk Management in Trading

Risk management is a critical aspect of trading, especially in dynamic and uncertain market environments. AGA’s zero liquidation risk strategy is designed to protect your investments and prevent losses that could result from sudden market fluctuations. By prioritizing risk management, AGA’s AI trading system allows you to trade with confidence, knowing that your investments are secure and well-protected.

Expanding Market Access with Multi-Liquidity Providers

AGA offers access to multiple liquidity providers, enabling you to tap into competitive pricing, fast execution, and deep market access. This multi-liquidity approach enhances trading efficiency and reduces the impact of market fluctuations on your trades, ensuring that you can execute orders quickly and seamlessly. By expanding your market access, AGA helps you capitalize on diverse trading opportunities and maximize your potential profits.

The Role of Liquidity Providers in Trading

Liquidity providers play a crucial role in financial markets by ensuring that there is a steady flow of assets available for trading. By partnering with multiple liquidity providers, AGA can offer you a diverse range of trading options and access to different asset classes, allowing you to diversify your portfolio and optimize your trading strategies. With enhanced market access, you can take advantage of favorable trading conditions and make informed investment decisions.

Harnessing Arbitrage Opportunities for Risk-Free Profits

AGA’s AI trading system is designed to identify arbitrage opportunities across different markets, enabling you to generate profits from price discrepancies without exposing yourself to traditional trading risks. By leveraging arbitrage strategies, AGA helps you create a consistent income stream with minimized risk exposure, allowing you to capitalize on profitable opportunities in the market.

The Benefits of Arbitrage Trading

Arbitrage trading involves taking advantage of price differentials between different markets or assets to generate profits. By capitalizing on these pricing inefficiencies, traders can earn risk-free profits while mitigating market risks. AGA’s AI trading system automates the arbitrage process, making it easier for you to identify and exploit profitable opportunities in real-time. With AGA’s innovative approach to arbitrage trading, you can effectively grow your wealth and increase your trading profits.

This image is property of images.unsplash.com.

Maximizing Returns with the Percentage Allocation Management Module (PAMM) Model

AGA’s Percentage Allocation Management Module (PAMM) model allows you to benefit from tailored investment management services based on your capital allocation. Once authorized by users, the system can automatically execute trades and distribute profits according to each investor’s capital proportion, ensuring that you receive returns proportional to your investment. This personalized approach to investment management helps you optimize your returns and maximize the efficiency of your trading activities.

The Power of Tailored Investment Management

PAMM models are designed to offer investors a customized approach to managing their investments, allowing them to allocate their capital strategically and optimize their trading activities. By leveraging the PAMM model, AGA ensures that your investments are managed efficiently and profitably, enabling you to benefit from professional investment strategies and advanced trading techniques. With the PAMM model, you can achieve your financial goals and secure your financial future with confidence.

Leveraging AGA’s Trading Packages and Rebate Structure for Enhanced Returns

AGA’s AI trading platform offers a structured rebate system that rewards investors based on their trading volume and capital allocation. By measuring profits based on trading volume, AGA provides different trade rebates depending on the amount of capital invested, incentivizing larger capital allocations with higher rebates. This structured rebate system enhances your overall returns and maximizes the profitability of your trades, allowing you to earn more with every trade.

The Benefits of Trade Rebates in Trading

Trade rebates play a significant role in incentivizing traders to increase their trading volume and capitalize on profitable opportunities in the market. By offering trade rebates based on trading activities, AGA encourages investors to trade more frequently and take advantage of favorable market conditions. This rebate system rewards traders for their trading efforts and allows them to earn additional income from their trades, ultimately enhancing their overall trading experience and profitability.

This image is property of images.unsplash.com.

Generating Dual Income with AGA’s Profit Sharing and Trade Rebate Model

AGA’s dual income model offers investors two key income streams: profit sharing and trade rebates. Investors receive 50% of the profits generated by AGA’s AI trading system, with profits automatically distributed to their accounts upon settlement. In addition, investors earn trade rebates based on their trading volume, with varying rates based on their fund allocation. This dual income model allows investors to maximize their returns and benefit from both consistent profit generation and additional income from trade rebates.

The Importance of Diversifying Income Streams in Trading

Diversifying income streams is essential for traders looking to maximize their profits and secure their financial future. By leveraging AGA’s dual income model, investors can earn both profits from their trades and additional income from trade rebates, ensuring a steady flow of revenue regardless of market conditions. This diversified approach to income generation helps investors manage their risks effectively and capitalize on multiple sources of revenue, enabling them to achieve their financial goals with confidence.

Earning Commission Rebates with AGA’s Referral System

AGA’s commission rebate system rewards agents for referring clients to the platform, offering rebates based on their sales volume. Agents can earn rebates of varying rates based on the level of sales they generate, incentivizing them to expand their client base and attract new investors to AGA’s trading platform. This commission rebate system provides agents with an additional source of income and encourages them to promote AGA’s innovative AI trading system to a wider audience.

The Role of Referral Programs in Trading

Referral programs play a crucial role in expanding a trading platform’s user base and increasing its market reach. By incentivizing agents to refer clients through commission rebates, AGA can attract new investors and promote its trading services to a broader audience. Referral programs help build a strong community of traders and agents who can benefit from AGA’s AI trading platform, creating a mutually beneficial relationship that supports long-term growth and sustainability.

Building a Thriving Trading Community with AGA’s Community Rebate System

AGA’s community rebate system rewards community leaders for building and maintaining active trading communities, offering rebates based on their community levels and trading activities. By providing community rebates to community leaders, AGA incentivizes them to expand their networks, facilitate trading activities, and promote a sense of camaraderie within the trading community. This rebate structure encourages sustained growth and network development among community leaders, creating a thriving and dynamic trading environment.

The Value of Community Building in Trading

Building a strong trading community is essential for fostering collaboration, sharing knowledge, and creating a supportive environment for traders. AGA’s community rebate system incentivizes community leaders to cultivate active and engaged trading communities, driving user engagement and encouraging participation in trading activities. By promoting community building, AGA helps traders connect with like-minded individuals, share insights and strategies, and build lasting relationships that support their trading success.

Ensuring Investor Protection with AGA’s Investor Protection Plan

AGA’s investor protection plan allocates a portion of each commission to fund a reserve that covers risks and ensures welfare planning for investors. By prioritizing investor protection, AGA safeguards investors’ interests, mitigates risks, and provides a secure trading environment for its users. This commitment to investor protection demonstrates AGA’s dedication to transparency, integrity, and accountability in its trading operations.

The Importance of Investor Protection in Trading

Investor protection is a fundamental aspect of trading that ensures investors’ interests are safeguarded and their investments are protected from potential risks and uncertainties. AGA’s investor protection plan goes above and beyond to prioritize the welfare and security of its investors, providing them with peace of mind and confidence as they trade on the platform. By implementing robust investor protection measures, AGA establishes itself as a trusted and reliable partner for investors looking to maximize their profits and secure their financial future.

Conclusion

In conclusion, AGA’s innovative AI trading system offers a unique and advanced platform for investors seeking low-risk, high-return opportunities in financial markets. By leveraging cutting-edge AI technology, zero liquidation risk strategies, arbitrage opportunities, and a dual income model, AGA provides investors with a secure, efficient, and transparent trading environment to generate consistent profits. With its diverse range of features, comprehensive rebate structure, and investor protection plan, AGA stands out as a leader in AI-driven trading, enabling investors to make fast cash effortlessly and achieve their financial goals with confidence.

If you have any questions, please don’t hesitate to contact us at info@fastcashva.com