Introduction

In this comprehensive guide, we will delve into the intricacies of maximizing your profits with the Angel Guardian Alliance’s (AGA) AI trading system and GoldFun’s gold trading platform. Whether you are an individual investor, institutional client, or trading enthusiast, this article will provide you with actionable insights to enhance your trading strategies, minimize risks, and unlock the full potential of these innovative platforms.

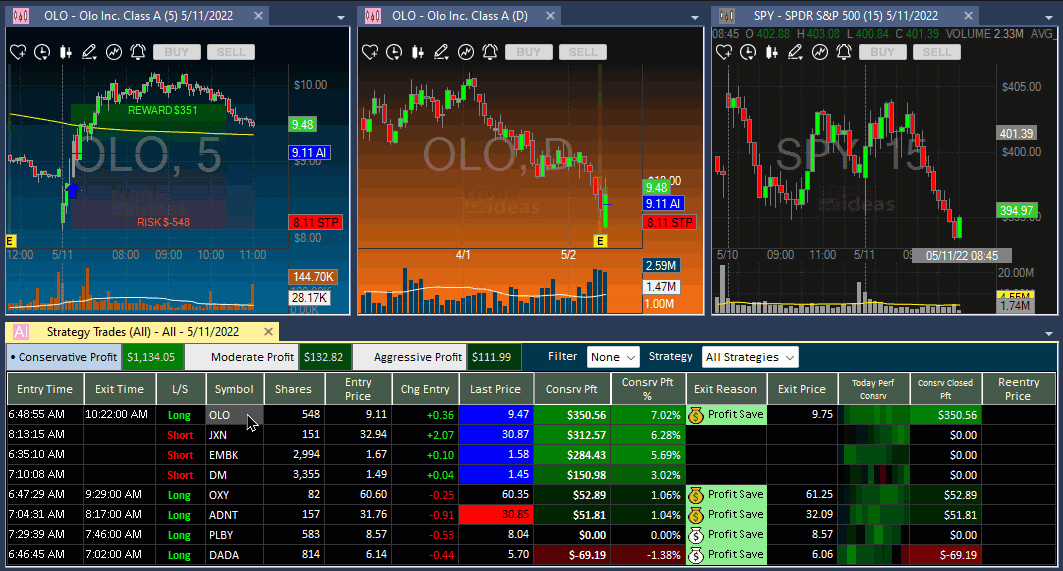

This image is property of www.trade-ideas.com.

Understanding AGA’s AI Quantitative Trading

AGA’s AI-driven trading system utilizes a quantum algorithm to automate analysis and trading processes. By leveraging data insights and market trends, AGA optimizes profitability while reducing the need for human intervention.

How AGA Achieves Zero Liquidation Risk

AGA employs ultra-high-frequency trading techniques with holding times under 30 seconds to mitigate liquidation risks, even in volatile market conditions. This approach ensures stable trading conditions and minimizes potential losses for investors.

The Benefits of Multi-Liquidity Access with AGA

AGA provides access to multiple liquidity providers, offering competitive pricing, rapid execution, and deep market access. This access enhances trading efficiency and minimizes the impact of market fluctuations on your investment portfolio.

Identifying Risk-Free Arbitrage Opportunities

AGA’s trading system is designed to identify arbitrage opportunities across various markets, enabling investors to generate consistent profits from price discrepancies without exposing themselves to traditional trading risks. This strategy creates a secure avenue for maximizing returns.

Exploring Gold Trading with GoldFun

GoldFun, a trusted member of the Hong Kong Gold & Silver Exchange Society, offers a secure and transparent platform for trading gold and other precious metals. By providing advanced trading tools, real-time market data, and secure storage solutions, GoldFun empowers clients to protect and grow their wealth through precious metal investments.

This image is property of i.ytimg.com.

Understanding the Percentage Allocation Management Module (PAMM) Model

AGA’s PAMM model offers customized investment management services, enabling the system to execute trades automatically and distribute profits based on each investor’s capital proportion. This model streamlines the trading process and ensures efficient capital allocation.

AGA AI Trading Packages and Rebate Structure

AGA offers competitive rebate structures based on trading volume, with higher investments receiving greater rebates. By participating in AGA’s AI trading packages, investors can enhance their returns and maximize profits through strategic fund allocation.

This image is property of www.trade-ideas.com.

Embracing the Dual Income Model with AGA

AGA’s dual income model allows investors to benefit from two income streams: profit sharing and trade rebates. By earning a percentage of AI-generated profits and bonuses based on trading volume, investors can diversify their revenue streams and achieve sustainable growth.

Leveraging the Commission Rebate System

AGA’s commission rebate system incentivizes agents to refer clients and build active trading communities. With tiered rebate structures based on sales volume, agents can earn additional income by expanding their network and fostering trading activity within the community.

This image is property of i.ytimg.com.

Promoting Community Growth Through Rebate Systems

AGA’s community rebate system encourages agents and leaders to build active trading communities by offering progressive rebates at different levels. This approach fosters network growth, incentivizes community participation, and enhances the overall trading ecosystem.

Enhancing Profit Settlements Through Automation

AGA’s automated profit settlement process ensures timely and accurate distribution of profits between the platform and users. With expected profit rates ranging from 3% to 8%, investors can benefit from regular and transparent profit settlements.

This image is property of i.ytimg.com.

Safeguarding Assets with GoldFun’s Secure Storage Solutions

GoldFun provides insured storage options for physical gold holdings, safeguarding customer assets against theft or loss. By utilizing secure storage solutions, investors can protect their precious metal investments and minimize risks associated with physical holdings.

Ensuring Investor Protection Through a Comprehensive Plan

AGA and GoldFun prioritize investor protection by contributing a portion of each transaction to a reserve fund. This fund manages unforeseen risks and supports welfare planning to ensure the long-term security and stability of investor assets.

Embracing Transparency and Real-Time Monitoring

Both AGA and GoldFun provide 24/7 access to trading accounts, real-time analytics, and insights to ensure full transparency and confidence for users. By offering comprehensive monitoring tools, these platforms empower investors to make informed decisions and maximize their trading potential.

By incorporating these strategies and leveraging the unique features of AGA’s AI trading system and GoldFun’s gold trading platform, you can optimize your profits, minimize risks, and achieve sustainable growth in the financial markets. Start exploring these innovative platforms today and unlock the full potential of AI-driven trading and secure gold investments.

If you have any questions, please don’t hesitate to contact us at info@fastcashva.com