Analysis and Forecast of Gold and Silver Prices

In the world of investments, both gold and silver are known as safe-haven assets and are often viewed as a hedge against inflation and economic uncertainty. Investors often turn to these precious metals during times of market volatility. As an investor, it’s crucial to understand the factors that influence the prices of gold and silver and to have a clear idea of what the medium-term price targets are.

This image is property of d1-invdn-com.investing.com.

Factors Influencing Gold Prices

Gold prices are influenced by a variety of factors, both macroeconomic and geopolitical. One of the primary drivers of gold prices is the overall health of the global economy. In times of economic uncertainty, investors tend to flock to gold as a safe haven asset, driving up its price. Geopolitical tensions, such as trade disputes and conflicts, also play a significant role in influencing the price of gold.

Understanding Silver Prices

Silver, like gold, is also considered a safe-haven asset. However, silver prices are often more volatile than gold prices due to the metal’s dual role as an investment and an industrial commodity. Industrial demand for silver, particularly in the electronics and solar panel industries, can impact its price significantly. Additionally, movements in the stock market and changes in the value of the US dollar can also affect silver prices.

Historical Price Trends of Gold and Silver

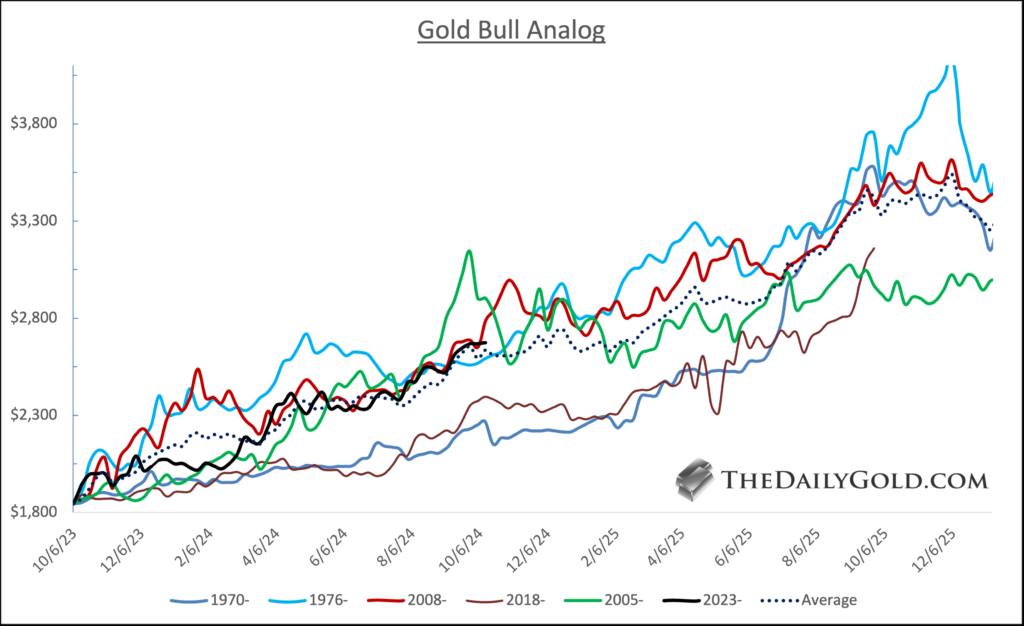

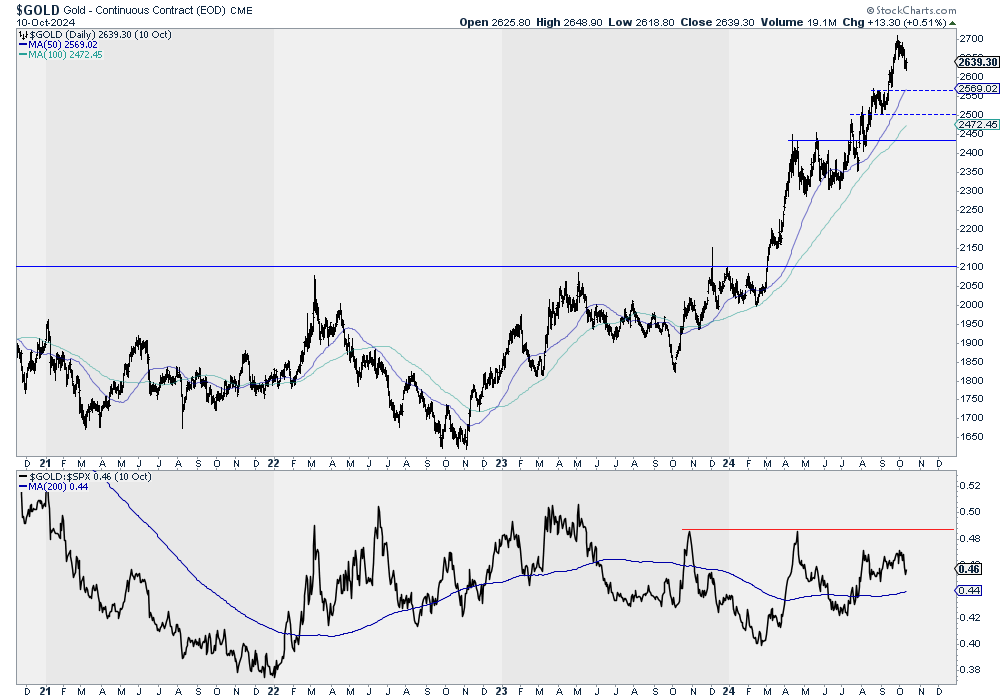

Historical price trends can provide valuable insights into the future performance of gold and silver prices. Looking at past price movements can help investors identify patterns and trends that may indicate where prices are headed in the medium-term. It’s essential to analyze historical price data and understand the factors that drove price movements in the past to make informed investment decisions.

Medium-Term Price Targets for Gold

When setting medium-term price targets for gold, investors typically consider a combination of technical analysis, fundamental analysis, and macroeconomic trends. Technical analysis involves studying past price movements and using chart patterns to predict future price movements. Fundamental analysis, on the other hand, looks at the underlying factors that drive gold prices, such as supply and demand dynamics and inflation expectations.

This image is property of d1-invdn-com.investing.com.

Medium-Term Price Targets for Silver

Setting medium-term price targets for silver involves similar considerations as setting price targets for gold. Technical analysis and fundamental analysis play a crucial role in predicting future price movements for silver. Additionally, factors such as industrial demand, market sentiment, and macroeconomic trends can also impact the medium-term price targets for silver.

Economic Indicators Impacting Gold and Silver Prices

Several economic indicators can impact the prices of gold and silver. For gold, factors such as inflation rates, interest rates, and currency movements can influence prices significantly. Additionally, economic data releases, such as GDP growth figures and employment reports, can also impact gold prices. For silver, industrial production data, manufacturing reports, and consumer sentiment indexes are essential economic indicators to consider.

This image is property of thedailygold.com.

Investment Strategies for Gold and Silver

When investing in gold and silver, it’s crucial to have a well-thought-out investment strategy in place. Diversification is key when investing in precious metals, as it helps spread risk across different assets. Investors can choose to invest in physical gold and silver, such as bullion coins and bars, or gain exposure to these metals through ETFs or mining stocks. It’s essential to consider your investment goals, risk tolerance, and time horizon when developing an investment strategy for gold and silver.

Market Sentiment and Price Volatility

Market sentiment and price volatility can have a significant impact on the prices of gold and silver. During times of economic uncertainty or geopolitical instability, market sentiment can drive investors towards safe-haven assets such as gold and silver, causing prices to rise. Additionally, price volatility in the broader financial markets can also impact the prices of gold and silver. As an investor, it’s essential to stay informed about market sentiment and price volatility to make informed investment decisions.

This image is property of d1-invdn-com.investing.com.

Conclusion

In conclusion, understanding the factors that influence the prices of gold and silver is essential for investors looking to set medium-term price targets for these precious metals. By analyzing historical price trends, economic indicators, and market sentiment, investors can make informed investment decisions and develop sound investment strategies for gold and silver. With the right knowledge and research, investors can navigate the complex world of precious metals investing and potentially achieve their investment goals.