Market Analysis in Precious Metals

In the world of investing, precious metals like gold and silver have always been popular choices due to their stability and intrinsic value. However, their prices can be quite volatile, influenced by various economic factors and geopolitical events. In this article, we will delve into the recent movements of gold and silver prices, particularly focusing on how they reacted to the release of the Non-Farm Payrolls (NFP) report and its impact on Federal Reserve rate-cut expectations.

This image is property of www.bullionvault.com.

Gold and Silver Price Movements

Gold and silver are often seen as safe-haven assets, meaning investors flock to them in times of economic uncertainty or market turmoil. On August 2, both gold and silver prices experienced a significant drop, with gold falling by 1.26% to $1,415.30 per ounce and silver dropping by 2.65% to $16.28 per ounce. The sudden decline left many investors wondering about the cause behind such a drastic movement in the precious metals market.

Non-Farm Payrolls (NFP) Report

The release of the NFP report by the U.S. Bureau of Labor Statistics is a highly anticipated event in the financial markets, as it provides crucial insights into the health of the U.S. economy. The report reveals the number of jobs added or lost in non-farming sectors, offering a snapshot of the labor market’s strength. On August 2, the NFP report exceeded expectations, showing an increase of 164,000 jobs in July, surpassing the forecasted 165,000 jobs. The positive data had a ripple effect across various assets, including gold and silver.

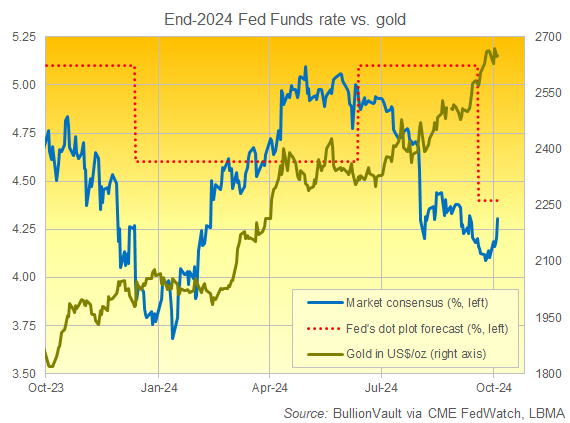

Impact on Federal Reserve Rate-Cut Expectations

The Federal Reserve closely monitors economic indicators like the NFP report to determine its monetary policy, including interest rates. A stronger-than-expected jobs report can diminish hopes for an aggressive rate cut by the Fed, leading to a rise in bond yields and a stronger U.S. dollar. As a result, gold and silver prices often react negatively to such data releases, as investors adjust their expectations for monetary policy.

Gold and Silver Rebound

Despite the initial drop in gold and silver prices following the NFP report, both precious metals rebounded in the subsequent trading sessions. Gold climbed back to $1,456.70 per ounce, while silver rose to $16.55 per ounce. The rebound highlighted the resilience of precious metals as investors sought to hedge against market uncertainties and economic risks.

This image is property of www.bullionvault.com.

Market Outlook and Investment Strategies

The recent volatility in gold and silver prices underscores the importance of diversification and risk management in investment portfolios. While precious metals can offer a safe haven during turbulent times, their prices can be influenced by a wide range of factors. Investors should consider a balanced approach to asset allocation, including exposure to different asset classes to mitigate risks and maximize returns.

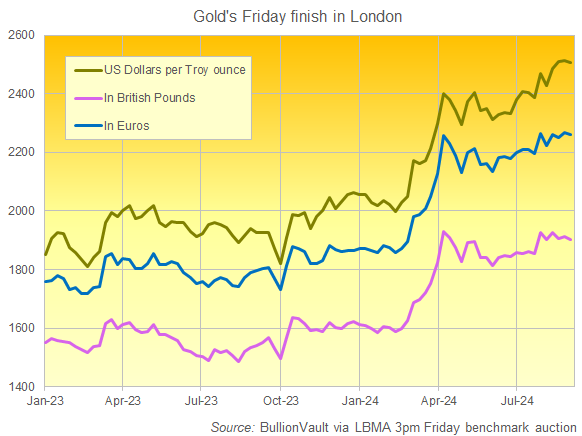

Comparison of Gold and Silver Prices

To provide a better understanding of the recent price movements in gold and silver, let’s compare their performance over the past month:

| Date | Gold Price (per ounce) | Silver Price (per ounce) |

|---|---|---|

| July 1 | $1,400.10 | $15.80 |

| July 15 | $1,420.50 | $16.20 |

| July 30 | $1,430.75 | $16.45 |

| August 5 | $1,456.70 | $16.55 |

Based on the data above, both gold and silver prices have shown a gradual increase over the past month, with gold outperforming silver in terms of percentage gains. This trend indicates growing investor interest in precious metals as a hedge against economic uncertainties.

This image is property of www.bullionvault.com.

Conclusion

In conclusion, the recent movements in gold and silver prices reflect the intricate relationship between economic data, market expectations, and investor sentiment. While the release of the NFP report initially led to a decline in precious metals, their subsequent rebound demonstrated their enduring appeal as safe-haven assets. Investors should remain vigilant and informed about market developments to make well-informed investment decisions in today’s dynamic financial landscape.