The Potential Impact of Economic Indicators on Silver Prices

Silver has long been considered a safe haven asset, especially during times of economic uncertainty. As an investor, you may be wondering what factors could cause silver prices to skyrocket in September. Let’s delve into the potential impact of economic indicators on silver prices and how they could affect your investment strategy.

This image is property of images.kitco.com.

Inflation and Silver Prices

Inflation is one of the key drivers of silver prices. When inflationary pressures are high, investors often turn to silver as a hedge against devaluing fiat currencies. The purchasing power of silver tends to increase during times of inflation, making it an attractive investment option.

Supply and Demand Dynamics

The fundamentals of supply and demand play a crucial role in determining silver prices. Silver is used in a wide range of industries, including electronics, solar panels, and jewelry. Any disruptions in the supply chain or changes in demand from these industries can have a significant impact on silver prices.

The US Dollar and Silver Prices

The US dollar has an inverse relationship with silver prices. When the value of the dollar weakens, silver prices tend to rise. This is because silver is priced in US dollars, so a weaker dollar makes silver more affordable for investors holding other currencies.

Geopolitical Tensions and Silver Prices

Geopolitical tensions can create uncertainty in financial markets, leading investors to seek safe haven assets like silver. Any escalation in geopolitical tensions, such as trade disputes or military conflicts, could cause silver prices to spike as investors look for ways to mitigate risk.

This image is property of i0.wp.com.

Interest Rates and Silver Prices

Interest rates set by central banks can also impact silver prices. When interest rates are low, the opportunity cost of holding non-yielding assets like silver is reduced, making it more attractive to investors. Conversely, when interest rates rise, the opportunity cost of holding silver increases, putting downward pressure on prices.

Silver as a Precious Metal

Silver is often considered a store of value, much like gold. As a precious metal, silver has intrinsic value and is not subject to the same risks as other financial assets. This makes it an ideal hedge against inflation and economic uncertainty.

This image is property of i.ytimg.com.

Silver ETFs and Investment Vehicles

For investors looking to gain exposure to silver prices without owning physical bullion, silver ETFs and other investment vehicles can be a convenient option. These investment products track the price of silver and allow investors to trade silver like a stock on major exchanges.

Market Sentiment and Silver Prices

Market sentiment can have a significant impact on silver prices. Investor sentiment, economic data releases, and analyst forecasts can all influence the direction of silver prices. As an investor, it is essential to stay informed about market sentiment and news that could affect silver prices.

This image is property of images.kitco.com.

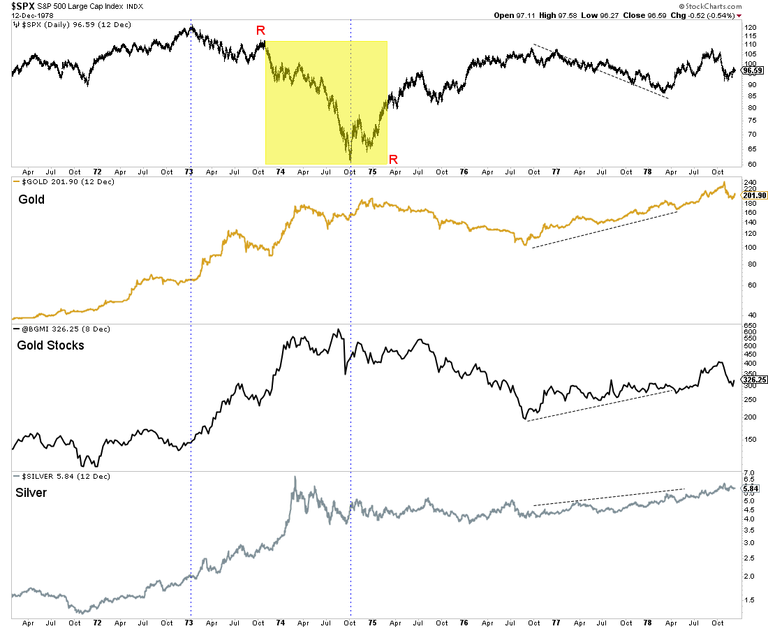

Historical Price Trends of Silver

Historical price trends can provide valuable insights into future price movements. By analyzing past performance, investors can identify patterns and trends that may help them make more informed investment decisions. Studying historical price data can also help investors understand the factors that drive silver prices.

Technical Analysis of Silver Prices

Technical analysis is a popular method used by traders to predict future price movements based on historical price data and trading volume. Chart patterns, moving averages, and other technical indicators can help investors identify potential entry and exit points for their trades.

This image is property of images.kitco.com.

Investing in Silver Mining Stocks

Investors looking to capitalize on rising silver prices may consider investing in silver mining stocks. These companies are directly impacted by fluctuations in silver prices and can offer significant upside potential during bull markets. However, investing in mining stocks also carries additional risks, such as operational issues and geopolitical instability.

Strategies for Investing in Silver

There are several strategies that investors can use to effectively invest in silver. Dollar-cost averaging, diversification, and setting clear investment goals are all important considerations for silver investors. By developing a sound investment strategy, investors can mitigate risks and maximize returns in the silver market.

Conclusion

As September approaches, there are several factors that could potentially cause silver prices to explode. From inflation and supply chain disruptions to geopolitical tensions and interest rate changes, the silver market is influenced by a wide range of economic indicators. By staying informed and understanding the dynamics of the silver market, investors can make better-informed decisions about their investment portfolios. Remember, silver is a safe haven asset with intrinsic value, making it an attractive option for investors looking to hedge against economic uncertainty.