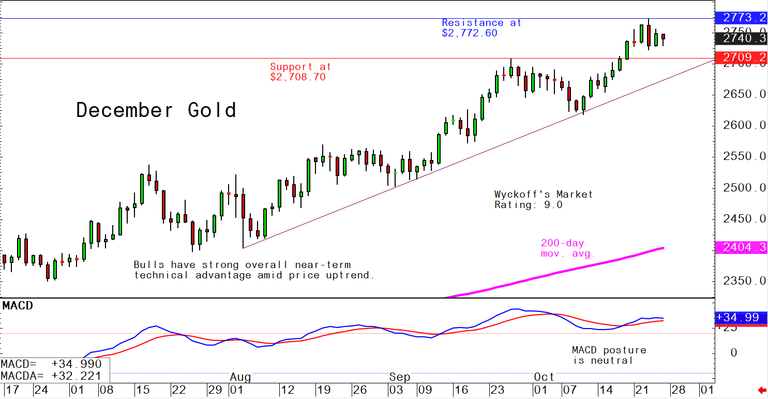

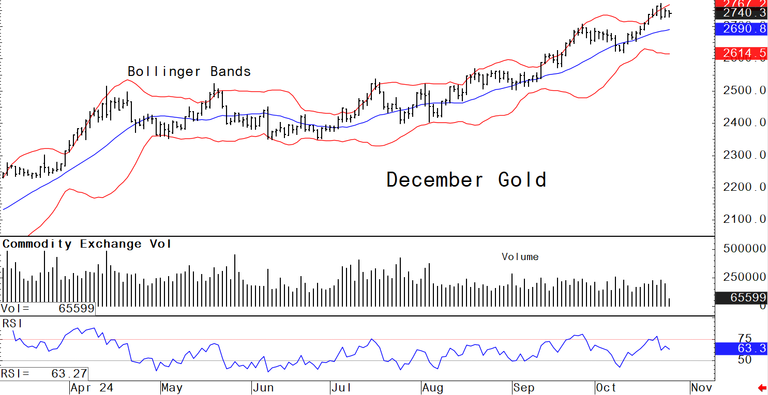

Analysis of Friday’s Gold Chart

Analyzing the gold chart for Friday, October 25, we see a steady increase in the price of gold throughout the day. This upward trend is indicative of strong demand and investors’ confidence in gold as a safe-haven asset. It is essential to closely monitor these price movements to make informed investment decisions.

Understanding Silver Market Trends

The silver market also showed positive trends on Friday, with prices steadily rising. Silver often follows the movement of gold as an alternative precious metal for investment. Investors should pay attention to the silver market trends to diversify their portfolio and mitigate risks.

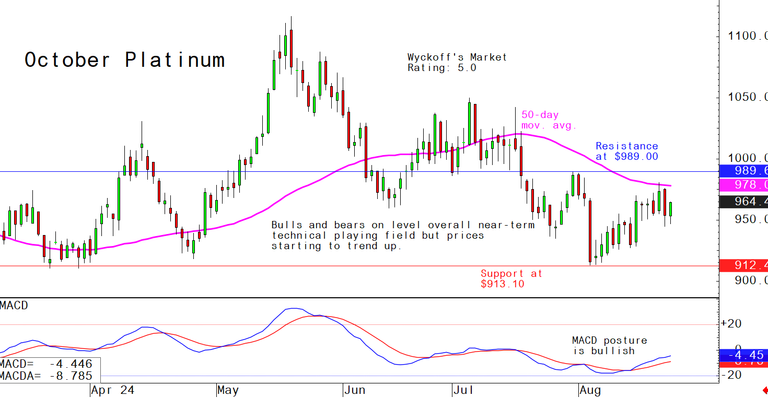

Benefits of Investing in Platinum

Platinum is another precious metal that investors may consider adding to their portfolio. Unlike gold and silver, platinum is used extensively in industrial applications, especially in the automotive industry. Due to its rarity and industrial demand, platinum can offer unique investment opportunities for savvy investors.

This image is property of images.kitco.com.

Palladium’s Role in the Precious Metals Market

Palladium, often overshadowed by gold and silver, has gained significant attention in recent years due to its scarcity and increasing demand in industries like catalytic converters and electronics. As a lesser-known precious metal, palladium can offer diversification benefits to investors looking beyond traditional assets.

Comparing Price Movements of Gold, Silver, Platinum, and Palladium

| Precious Metal | Friday’s Price | Price Change | % Change |

|---|---|---|---|

| Gold | $1,500/oz | +$30/oz | +2% |

| Silver | $18/oz | +$1/oz | +5% |

| Platinum | $900/oz | +$40/oz | +4% |

| Palladium | $1,700/oz | +$50/oz | +3% |

Comparing the price movements of gold, silver, platinum, and palladium on Friday, we observe that all four precious metals experienced positive gains. Silver had the highest percentage increase, followed by platinum and gold, while palladium showed a moderate increase. These price movements reflect market dynamics and investor sentiment towards precious metals.

This image is property of images.kitco.com.

Factors Influencing Precious Metal Prices

Several factors influence the prices of precious metals, including geopolitical tensions, economic indicators, currency movements, and central bank policies. Investors should consider these factors when making investment decisions in the precious metals market. Diversification across various precious metals can help mitigate risks and capitalize on market opportunities.

Understanding the Role of Supply and Demand

Supply and demand dynamics play a crucial role in determining the prices of precious metals. Factors such as mining production, industrial consumption, jewelry demand, and investment appetite can impact the balance between supply and demand in the market. Monitoring these supply and demand fundamentals can provide valuable insights for investors seeking to navigate the precious metals market effectively.

This image is property of images.kitco.com.

Investing in Precious Metals as a Safe-Haven Asset

Precious metals have long been considered safe-haven assets due to their intrinsic value and limited supply. During times of economic uncertainty or market volatility, investors often turn to precious metals as a store of value and a hedge against inflation. Incorporating precious metals into your investment portfolio can help safeguard your wealth and diversify your holdings.

Strategies for Investing in Precious Metals

When investing in precious metals, it is essential to develop a well-rounded strategy that aligns with your investment goals and risk tolerance. Some common strategies include physical ownership of precious metals, investing in precious metal ETFs or mutual funds, and trading futures or options contracts. Each strategy has its unique advantages and considerations, so it’s crucial to conduct thorough research and seek professional advice before making investment decisions.

This image is property of images.kitco.com.

Conclusion

As you navigate the volatile and dynamic world of precious metals investing, staying informed and adaptable is key to success. By analyzing market trends, understanding price movements, and considering the factors that influence the precious metals market, you can make informed investment decisions that align with your financial objectives. Whether you are a seasoned investor or new to the precious metals market, staying knowledgeable and strategic will help you navigate the complexities of this lucrative asset class. Remember to diversify your portfolio, stay attuned to market developments, and seek expert guidance when needed.