Introduction

Gold has always been considered a valuable and prestigious asset, but in recent times, its price has been steadily increasing. This article aims to explore the reasons behind this surge in gold price and why investors should pay attention to these developments. Whether you are a beginner looking to understand the benefits of gold investment or an experienced investor seeking a reliable platform like GoldFun, this article will provide valuable insights into the world of gold investment.

Understanding the Rising Gold Price:

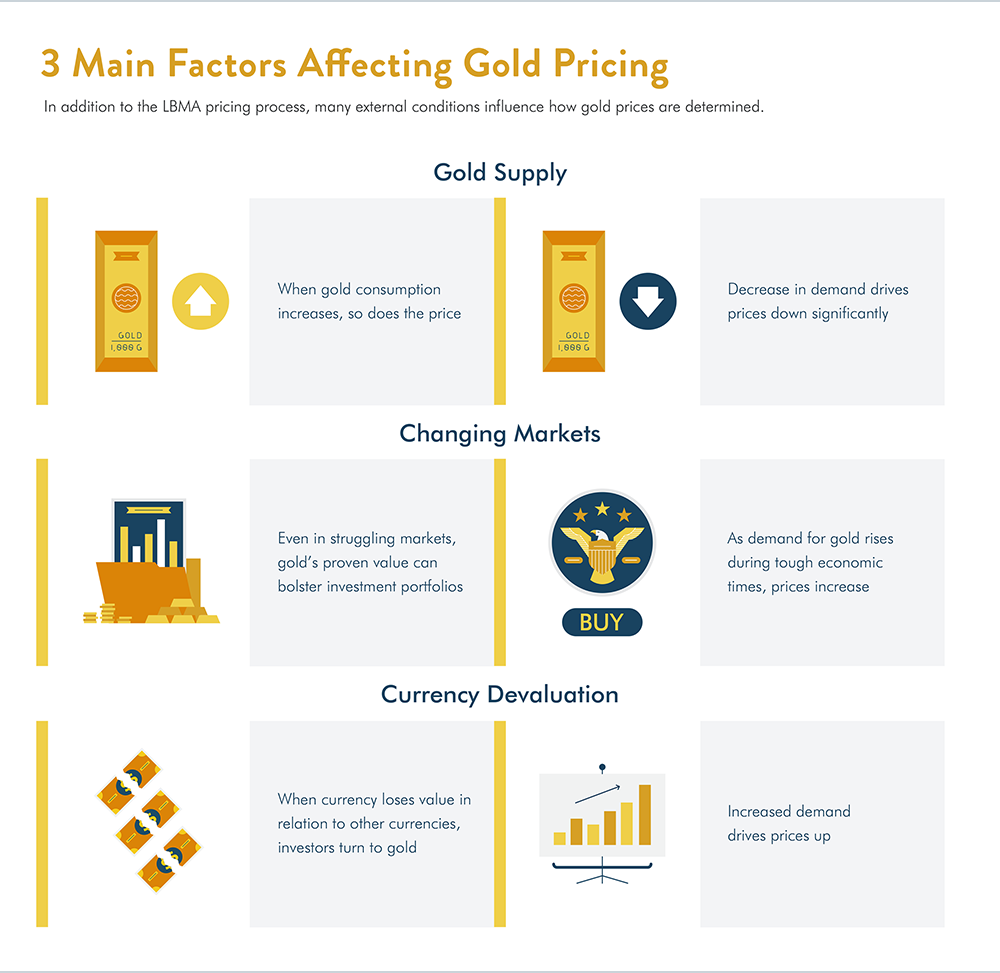

Before delving into the specific reasons behind the increasing gold price, it is essential to understand the broader economic and geopolitical factors that influence the value of this precious metal. Gold has long been viewed as a safe-haven asset, a store of value, and a hedge against inflation and currency devaluation. In times of economic uncertainty or geopolitical instability, investors often turn to gold as a reliable asset that can help protect their wealth.

Market Volatility and Economic Uncertainty

One of the primary drivers behind the rising gold price is market volatility and economic uncertainty. Global events such as trade tensions, geopolitical conflicts, and the ongoing COVID-19 pandemic have created an environment of instability in financial markets. During times of uncertainty, investors tend to flock to safe-haven assets like gold, driving up demand and consequently, the price of gold.

:max_bytes(150000):strip_icc()/What-moves-gold-prices_round2-1f495b66525544fa90f5bc7ec01b3753.png)

This image is property of www.investopedia.com.

Currency Devaluation and Inflation Hedge

Another key factor contributing to the increase in gold price is the role of gold as a hedge against currency devaluation and inflation. Central banks around the world have been implementing aggressive monetary policies, such as quantitative easing and low-interest rates, to stimulate economic growth. These measures can lead to currency devaluation and inflation, eroding the purchasing power of fiat currencies. In such a scenario, gold serves as a reliable store of value that can protect against the loss of value in paper money.

:max_bytes(150000):strip_icc()/what-drives-the-price-of-gold.aspx_final-ba9f1dae6cd34de18e6021738f196de5.png)

This image is property of www.investopedia.com.

Increase in Demand from Emerging Markets

Emerging markets, particularly countries like China and India, have been significant drivers of gold demand in recent years. Rising incomes, increasing consumer demand for gold jewelry, and cultural affinity towards gold as a symbol of wealth and status have fueled the demand for physical gold in these markets. As a result, the increase in demand from emerging markets has put upward pressure on the gold price.

Emphasizing Opportunity for International Investing

Investors should pay attention to the increasing demand for gold from emerging markets as it presents an opportunity for international investing. As these markets continue to grow and prosper, the demand for gold is likely to remain strong, contributing to the long-term appreciation of gold prices.

This image is property of av.sc.com.

Supply Constraints and Production Challenges

Despite the strong demand for gold, the supply side of the equation has been facing challenges in recent years. Gold mining is a resource-intensive process that requires significant investments in exploration, extraction, and production. Factors such as declining ore grades, environmental regulations, and operational disruptions have constrained the supply of newly mined gold. As a result, the limited supply of gold has contributed to the upward pressure on its price.

This image is property of www.sbcgold.com.

Investment and Portfolio Diversification

Gold is not only a valuable asset in its own right but also plays a crucial role in diversifying investment portfolios. As traditional asset classes like stocks and bonds become increasingly volatile, investors are turning to alternative assets like gold to spread risk and enhance returns. Gold has a low correlation with other financial assets, making it an effective diversification tool that can help reduce portfolio volatility and improve overall risk-adjusted returns.

Encouraging a Balanced Investment Portfolio

Investors should consider adding gold to their investment portfolios to achieve a well-diversified and balanced asset allocation. By including gold alongside stocks, bonds, and other assets, investors can potentially reduce the impact of market fluctuations and protect their wealth during uncertain times.

This image is property of www.briggsandcoops.com.

Conclusion

The increasing gold price is a reflection of the complex interplay between economic, geopolitical, and market-driven factors. Investors should pay attention to these developments and consider the role of gold in their investment portfolios. Whether as a hedge against inflation, a safe-haven asset in times of uncertainty, or a diversification tool for long-term wealth preservation, gold offers a range of benefits that make it a valuable addition to any investment strategy. By understanding the reasons behind the rising gold price and leveraging platforms like GoldFun for efficient trading and storage, investors can capitalize on the opportunities presented by this precious metal.

If you have any questions, please don’t hesitate to contact us at info@fastcashva.com