Attention, property owners in the DC Metropolitan area! If you’ve been wondering about the fate of the housing market in Washington DC, Maryland, Virginia, and West Virginia, then this article is for you. With the catchy title “Will DC Housing Market Crash: Stay Ahead with the Top 4 Insider Predictions and Sell Before It’s Too Late,” we aim to provide you with valuable insights and predictions that will help you stay ahead of the game. Whether you’re looking to sell your residential or commercial property quickly or seeking investment opportunities, this article will arm you with the knowledge you need to make informed decisions. So, let’s dive in and explore the future of the DC housing market together!

Introduction to the DC Housing Market

As property owners in the DC Metropolitan area, we understand the importance of staying informed about the housing market. The DC housing market is a dynamic and ever-changing landscape, influenced by various factors such as the economy, policy changes, supply and demand, and interest rates. In this comprehensive article, we will delve into the current state of the DC housing market, explore insider predictions, and provide strategies on how to navigate these market trends effectively.

Overview of the current state of the DC housing market

The DC housing market has been experiencing a period of growth and stability in recent years. With its strong economy, diverse job market, and desirable city amenities, DC continues to attract homebuyers and investors alike. Property values have been steadily increasing, making it an opportune time to consider selling your property. However, as with any market, there are potential risks and uncertainties that need to be taken into account.

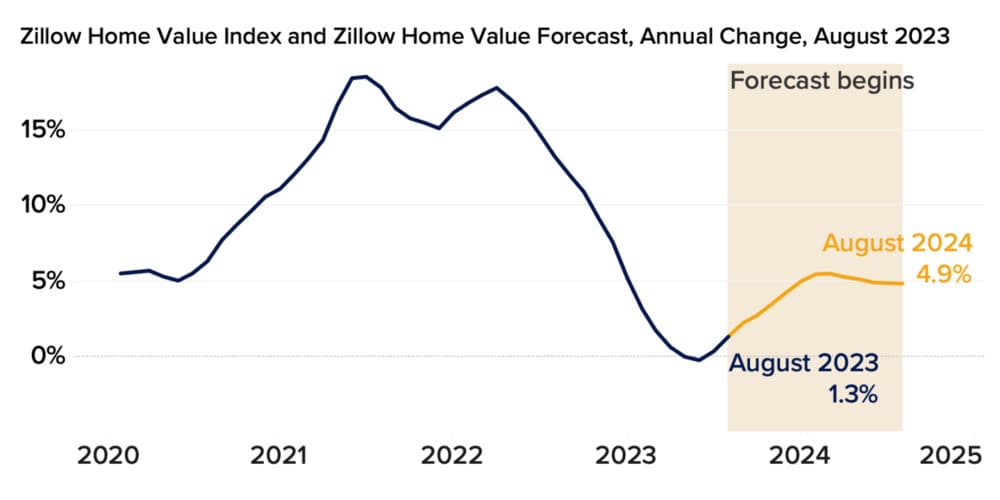

This image is property of thumbor.forbes.com.

Factors that can influence the market

Several key factors play a significant role in shaping the DC housing market. Economic indicators, such as employment rates, GDP growth, and inflation, can have a direct impact on the real estate market. Policy and legislation changes can also greatly influence the housing market, as they can affect zoning regulations, tax incentives, and lending practices. Additionally, supply and demand dynamics and fluctuations in interest rates can further impact housing prices and market activity.

Importance of staying informed about market trends

It is crucial for property owners to stay informed about current market trends in order to make informed decisions. By understanding the factors that influence the housing market, we can better position ourselves to take advantage of favorable conditions and minimize potential risks. Staying ahead of market changes allows us to adapt our strategies accordingly, whether it means selling our property at the right time or making informed investment decisions.

This image is property of i2.wp.com.

Insider Prediction 1 – Economic Factors

Analyzing economic indicators is a crucial step in predicting how the DC housing market will be affected. By examining factors such as employment rates, GDP growth, and inflation, we can gain insights into the overall health of the economy and its potential impact on the housing market. For example, a strong job market and increased consumer spending may lead to a surge in housing demand and higher property prices.

Predictions on how the economy will impact the market can help property owners make proactive decisions. If economic indicators suggest a period of growth, it may be an opportune time to sell and capitalize on rising property values. Alternatively, if indicators point towards an economic downturn, it may be prudent to hold off on selling or adjust pricing strategies to align with market conditions.

To position ourselves in response to economic trends, it is essential to work with trusted real estate professionals who have a deep understanding of the local market. They can provide valuable insights and advice on pricing strategies, timing, and market conditions, ensuring that we make informed decisions that align with our financial goals.

Insider Prediction 2 – Policy and Legislation

Policy and legislation changes can have a profound impact on the DC housing market. Zoning regulations, tax incentives, and lending practices are just a few examples of how government policies can shape the real estate landscape. Being aware of potential policy changes and their effects is crucial for property owners.

By examining policy and legislation changes, we can make predictions on how these changes may impact the housing market. For instance, if zoning regulations are relaxed, it may lead to increased housing supply and potentially lower prices. Conversely, if tax incentives for homeownership are phased out, it may reduce demand and have a dampening effect on property prices.

Adapting to policy changes requires a proactive approach. Property owners should stay informed about proposed legislation and advocate for their interests when necessary. It is also important to seek guidance from real estate professionals who specialize in the local market and can provide insights into how policy changes may affect property values and market activity.

This image is property of i2.wp.com.

Insider Prediction 3 – Supply and Demand

Supply and demand dynamics play a central role in the DC housing market. Understanding trends in supply and demand can help property owners make informed decisions about selling or investing in real estate. For example, if there is a shortage of housing inventory and high demand from buyers, it may indicate a seller’s market, where property prices are likely to appreciate.

Predicting future trends in supply and demand requires a careful analysis of market data and insights from experts. By examining historical data, current market conditions, and demographic trends, we can make informed predictions about market activity. This information can help property owners determine the best timing for selling their property or identifying potential investment opportunities.

To leverage supply and demand to our advantage, it is important to work with a knowledgeable real estate agent who can provide insights into local market conditions. They can help us identify emerging trends, evaluate the competition, and develop effective pricing and marketing strategies to maximize our property’s value.

Insider Prediction 4 – Interest Rates

Interest rates have a significant impact on the DC housing market. Changes in interest rates can affect mortgage affordability and ultimately influence homebuyer demand. By analyzing current interest rates and their historical trends, we can gain insights into how they may impact the housing market in the future.

Analyzing the impact of interest rates on the market can help property owners make strategic decisions. For instance, if interest rates are low, it may incentivize buyers to enter the market, leading to increased demand and potentially higher property prices. Conversely, if interest rates are high, it may discourage buyers and result in a slowdown in market activity.

To navigate interest rate fluctuations, property owners should consider consulting with mortgage experts who can provide insights into current rates and potential future changes. They can help us understand the impact of interest rates on our property’s value, affordability for buyers, and market dynamics. This information can guide our decision-making process, whether it involves selling, refinancing, or adjusting pricing strategies.

This image is property of www.noradarealestate.com.

Benefits of Selling Before a Market Crash

Selling your property before a market crash can have several advantages. By accurately timing the market, property owners can avoid potential losses and maximize their profits. Selling before a market crash allows us to take advantage of high property values and a robust buyer demand, ensuring a smooth and profitable selling experience.

Case studies and success stories of those who sold at the right time can provide valuable insights and inspiration. By examining real-life examples, we can learn from others’ experiences and gain a better understanding of the benefits of selling before a market crash. These stories can serve as a guide for property owners who are considering selling their property and want to make informed decisions.

To successfully time our sale, we need to closely monitor market trends and work with real estate professionals who have a deep understanding of the local market. They can provide insights into market conditions, pricing strategies, and potential risks. By leveraging their expertise, we can increase our chances of selling before a market crash and reaping the benefits.

Risks of Waiting Too Long to Sell

Waiting too long to sell in a declining market can have serious consequences for property owners. As market conditions deteriorate, property values may decline, resulting in potential financial losses. Real-life examples of individuals who missed the opportunity to sell at the right time can highlight the risks of waiting too long and serve as cautionary tales.

To avoid the risks of waiting too long to sell, property owners should closely monitor market conditions and act proactively. It is essential to stay informed about market trends, consult with real estate experts, and regularly assess the value of our property. By being proactive and responsive to market changes, we can make informed decisions and avoid potential losses.

Taking steps to avoid the risks of waiting too long involves being realistic about market conditions and setting reasonable expectations for our property’s value. It may also require adjusting pricing strategies, considering alternative selling options, or seeking professional advice on how to position our property in a declining market.

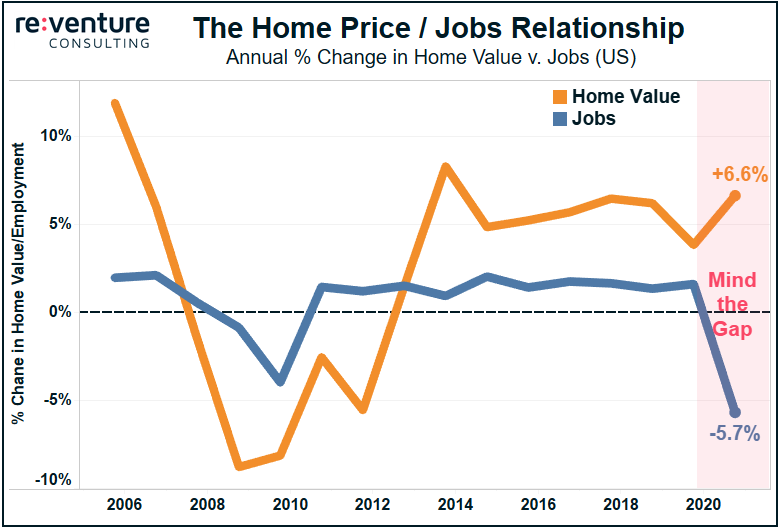

This image is property of reventureconsulting.com.

How to Stay Informed about the DC Housing Market

Staying informed about the DC housing market involves accessing various sources of information and utilizing tools and resources to track market trends. Property owners have access to a wealth of information that can help them interpret and analyze market data effectively.

Different sources of information, such as real estate websites, news outlets, and local market reports, can provide valuable insights into market trends. It is important to regularly review these sources to stay updated on new developments, policy changes, and market updates. Additionally, working with a knowledgeable real estate agent who specializes in the local market can provide us with up-to-date and accurate information.

To interpret and analyze market data effectively, property owners should familiarize themselves with important indicators and metrics. Understanding terms like median home price, days on market, and absorption rate can provide valuable insights into market conditions and help us make more informed decisions. Real estate professionals can guide us through the process of interpreting and analyzing market data effectively, ensuring that we stay ahead of market changes.

Utilizing tools and resources designed for tracking market changes can give property owners a competitive edge. Online platforms, market analysis tools, and real estate apps can provide real-time data, market forecasts, and interactive maps that help us visualize and navigate the housing market effectively. By leveraging these tools, we can stay ahead of market trends and make more informed decisions.

Strategies for a Quick Sale

Selling a property quickly requires effective strategies and preparation. By utilizing proven techniques, preparing our property for a fast sale, and implementing targeted marketing strategies, we can attract buyers and expedite the selling process.

Effective techniques for selling a property quickly include setting the right price, staging the property, and optimizing its curb appeal. Properly pricing our property is crucial, as it can generate interest and attract potential buyers. Staging the property involves decluttering, depersonalizing, and arranging the space in a way that appeals to buyers. Optimizing curb appeal involves enhancing the exterior of the property, ensuring that it makes a positive first impression.

Preparing our property for a fast sale also involves addressing any necessary repairs or renovations. Making our property move-in ready can increase its desirability and facilitate a quicker sale. It is important to focus on essential repairs and improvements that can maximize our property’s value without exceeding our budget.

To attract buyers quickly, targeted marketing strategies are essential. This may include professional photography, virtual tours, online listings, and targeted advertising campaigns. By utilizing multiple marketing channels, we can increase visibility and reach a wide pool of potential buyers, increasing our chances of selling the property quickly.

Conclusion

In conclusion, navigating the DC housing market requires staying informed about market trends, analyzing economic factors, policy and legislation changes, supply and demand dynamics, and interest rates. By understanding these factors and utilizing insider predictions, property owners can position themselves strategically to make informed decisions.

Selling our property before a market crash can provide several advantages, while waiting too long to sell can expose us to potential risks. It is essential to stay proactive and regularly assess market conditions to make the most of favorable opportunities and mitigate potential losses. By utilizing strategies for a quick sale and staying informed about the market, property owners can maximize their profits and achieve their financial goals.

In the dynamic world of real estate, taking action sooner rather than later is crucial. By staying ahead with the top insider predictions, monitoring market trends, and working with real estate professionals, property owners can navigate the DC housing market effectively and make informed decisions that align with their financial objectives. With the right knowledge and strategies, we can successfully navigate the DC housing market and achieve success in our property endeavors.